Seeing your house sit on the market without any bites is the ultimate frustration. And unfortunately, some sellers are in that tricky spot today.

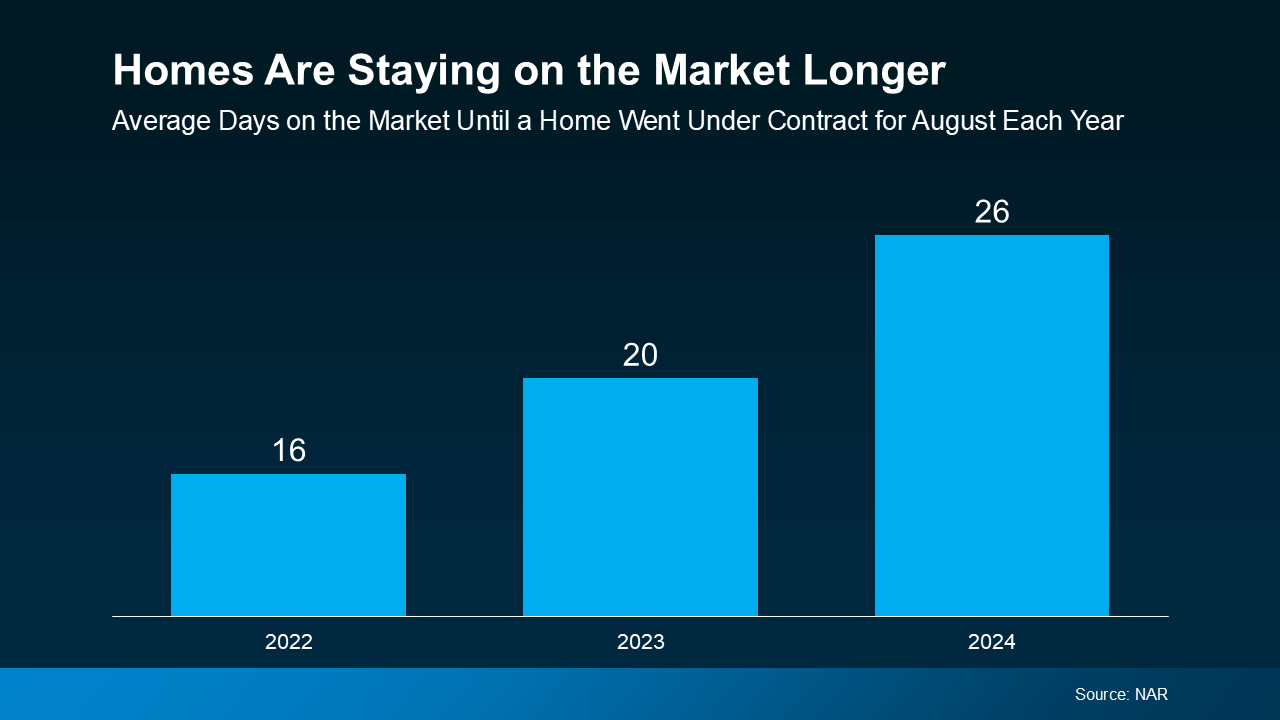

According to data from the National Association of Realtors (NAR), the average time a house spends on the market has increased over the past few years (see graph below):

A recent post from Realtor.com notes a similar trend:

“During the week ending Sept. 14, homes stayed on the market eight days longer compared to last year. With more choices available and mortgage rates expected to fall, buyers are taking their time, which means sellers will need to be patient and flexible.”

Some of that is because inventory has gone up, so buyers have more options. And higher mortgage rates have definitely slowed demand over the past two years, and that’s out of your control. But here’s the secret. There’s something you can control – it's also where those other sellers missed the mark. They didn’t work with the right agent.

Make no mistake, with the right strategy and agent partner, your house can still sell quickly, even today.

If time matters to you, you need to partner with an agent who understands this shifting market. That agent will be your go-to resource on what buyers are looking for right now, and how to position your home to hit the mark.

Here are just a few tips a great real estate agent will walk you through. They may seem simple, but advice like this can make all the difference.

1. Competitive Pricing: One of the most critical factors in selling your home quickly is setting the right price. A local real estate agent will do a competitive market analysis by reviewing recent sales and current listings for your area. Then, they’ll use that data to make sure your home is priced accurately for today’s market. This strategic pricing approach is the best way to make sure you’re hitting the sweet spot on price. If you don’t lean on an agent for this, it can really slow your process down. As U.S. News says:

“. . . setting an unrealistically high price with the idea that you can come down later doesn’t work in real estate . . . A home that’s overpriced in the beginning tends to stay on the market longer, even after the price is cut, because buyers think there must be something wrong with it.”

2. The Home’s Condition: Homes that are well maintained, have great curb appeal, and are updated with modern finishes tend to sell faster. So, if speed is a priority, make sure your house makes a great first impression. An agent is a key resource on what buyers will be looking for, if staging is worthwhile, and what repairs you need to tackle before you list. Ramsey Solutions offers this advice:

“In the spirit of selling your home fast, take care of things now that will be a problem in the closing process. Talk to your agent about fixes you’ll need to make to pass the home inspection, like: plumbing problems, roof damage, electrical issues, HVAC glitches. . . These are issues you’ll be expected to take care of before any buyers close on your house—you might as well get ahead of the game to help your home sell faster.”

3. Incentives and Extras: If you want to stand out from those other homes on the market, offering incentives or concessions, like help with closing costs, a home warranty, or including additional items (like appliances or furniture) with the sale can sweeten the deal for buyers. A real estate agent can suggest the right incentives to offer based on current market conditions and buyer expectations, so you can close the sale even faster.