(Published on - 4/27/2023 5:52:47 PM)

We've all seen the news. Mortgage Rates are higher than they have been in years and so, you've decided to put off your home search until they come back down. A good way to save money, right? Actually, you may want to make your move before May 10th, according to Barry Habib, economist and VP of MBS Highway.

The 2% rates we saw in the last couple of years were historically, even unnaturally, low. So, you should not wait to purchase your home thinking that they will come back to those levels because they are not likely to. Habib suggests that we could see rates in the 5% range by the May 10th reading of the Core CPI which will energize sleeping buyers. Combined with Flagstaff’s traditionally low levels of inventory, this could push home prices higher.

What drives mortgage rates?

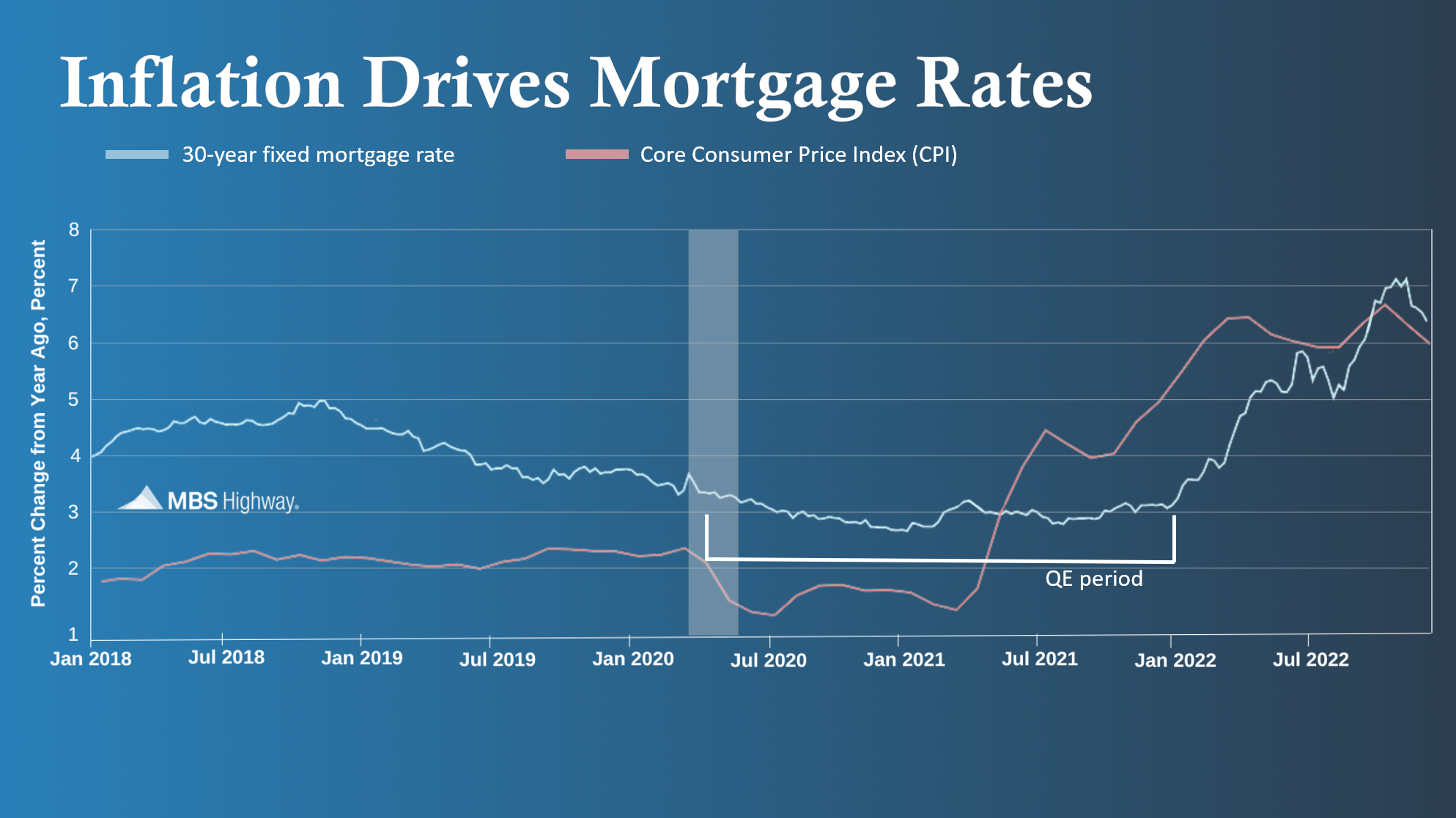

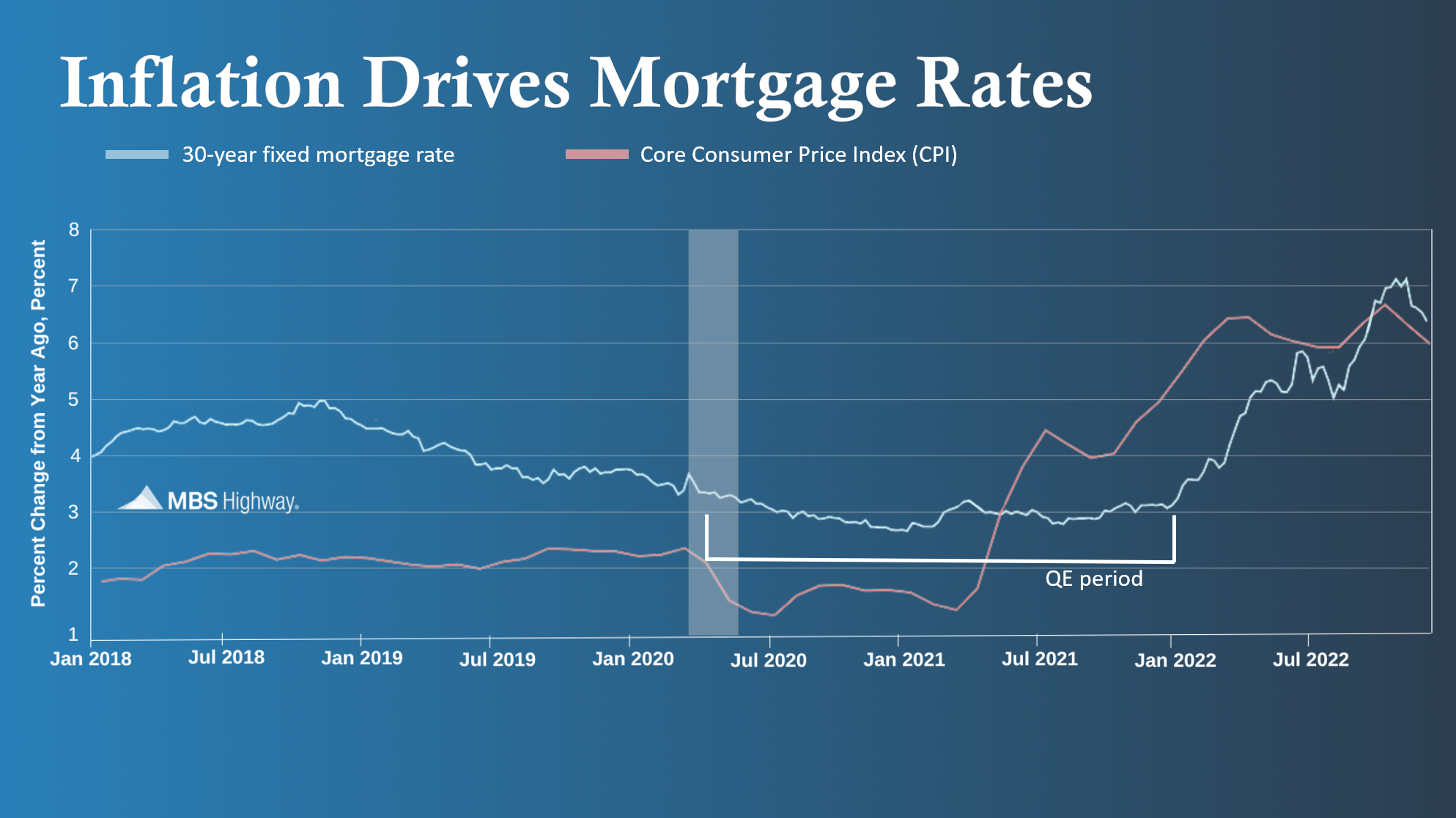

The Fed Rate does not control Mortgage Rates as many might think. The "Fed Rate" we keep hearing about is for short-term loans like credit cards and auto loans, not long-term loans like a home mortgage. Mortgage Rates are adjusted by lenders based on inflation. The Fed will adjust the Fed Rate to curb inflation so they may look like they are connected but Mortage Rates are driven by inflation.

Notice the period where mortgage rates stayed relatively flat even though inflation had increased. This was through the process of Quantitative Easing, where the government was buying mortgage-backed securities to keep rates artificially low. The moment the government hinted that they would stop doing this, the mortgage rates did exactly what they normally do and increased to match inflation.

Rates are expected to lower this year.

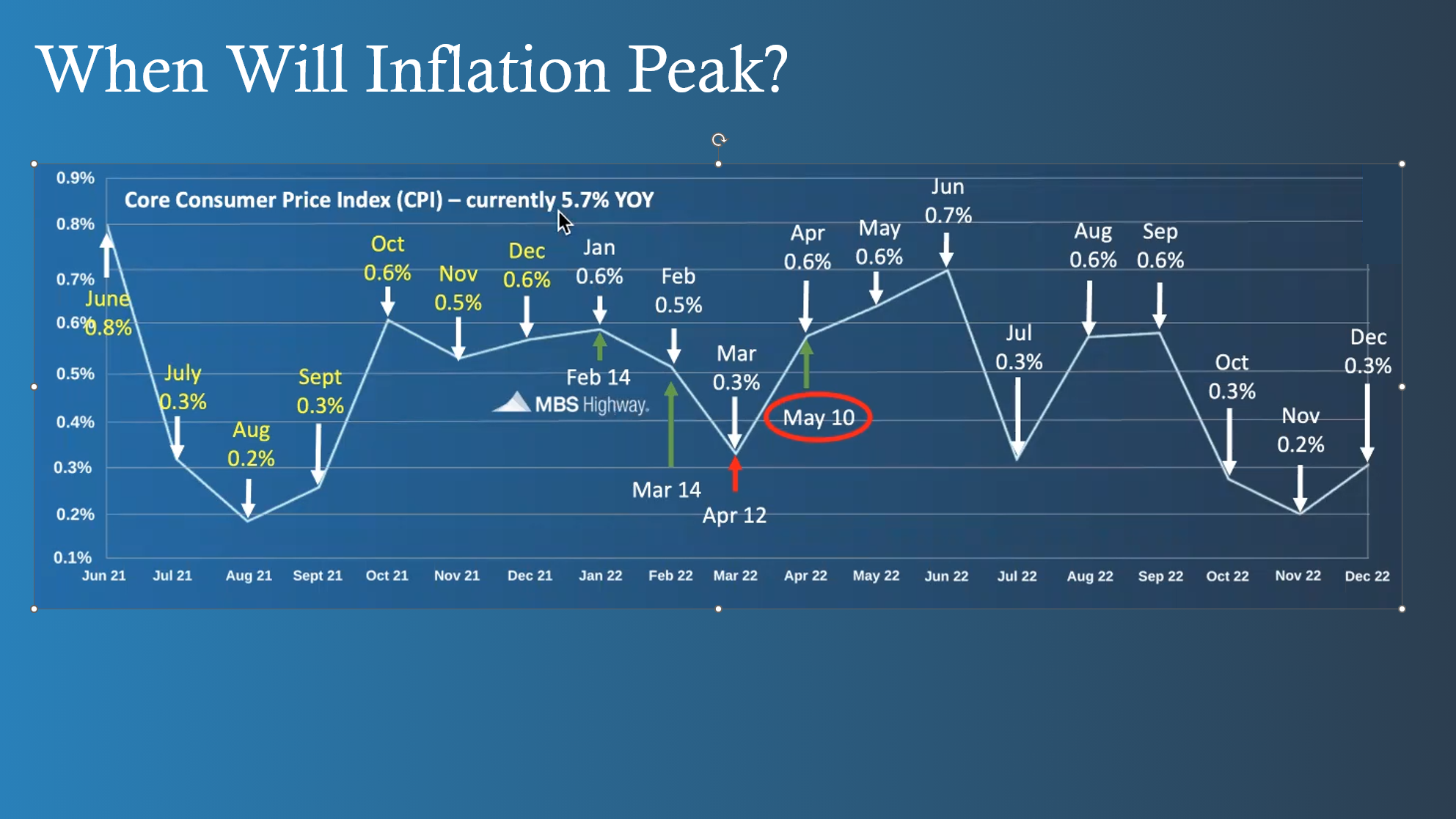

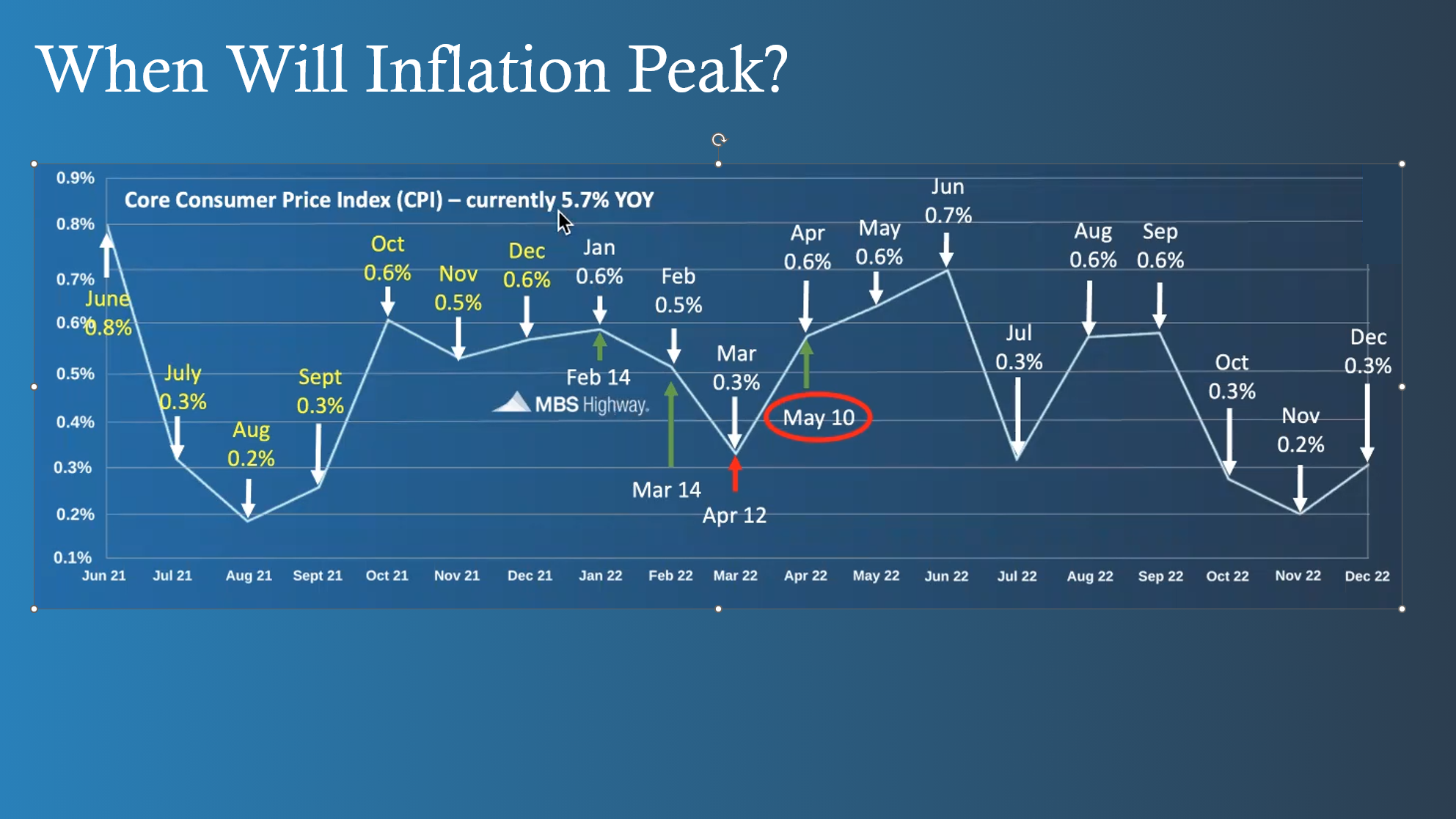

Inflation is measured by the Core Consumer Price Index. Each month, a reading of the Core CPI is done to determine the price of goods and whether they are becoming more or less expensive. For this purpose, each reading is compared to the same month from the prior year. This coming May offers the best chance at a Core CPI reading that would signal a decline in inflation which would result in lower mortgage rates. The timing will coincide with the annual cycle of new home listings but, the inventory is unlikely to be the 4-6 months’ supply that indicates a balanced market and buyers will once again need to be competitive with their offers.

But what about the rising inventory?

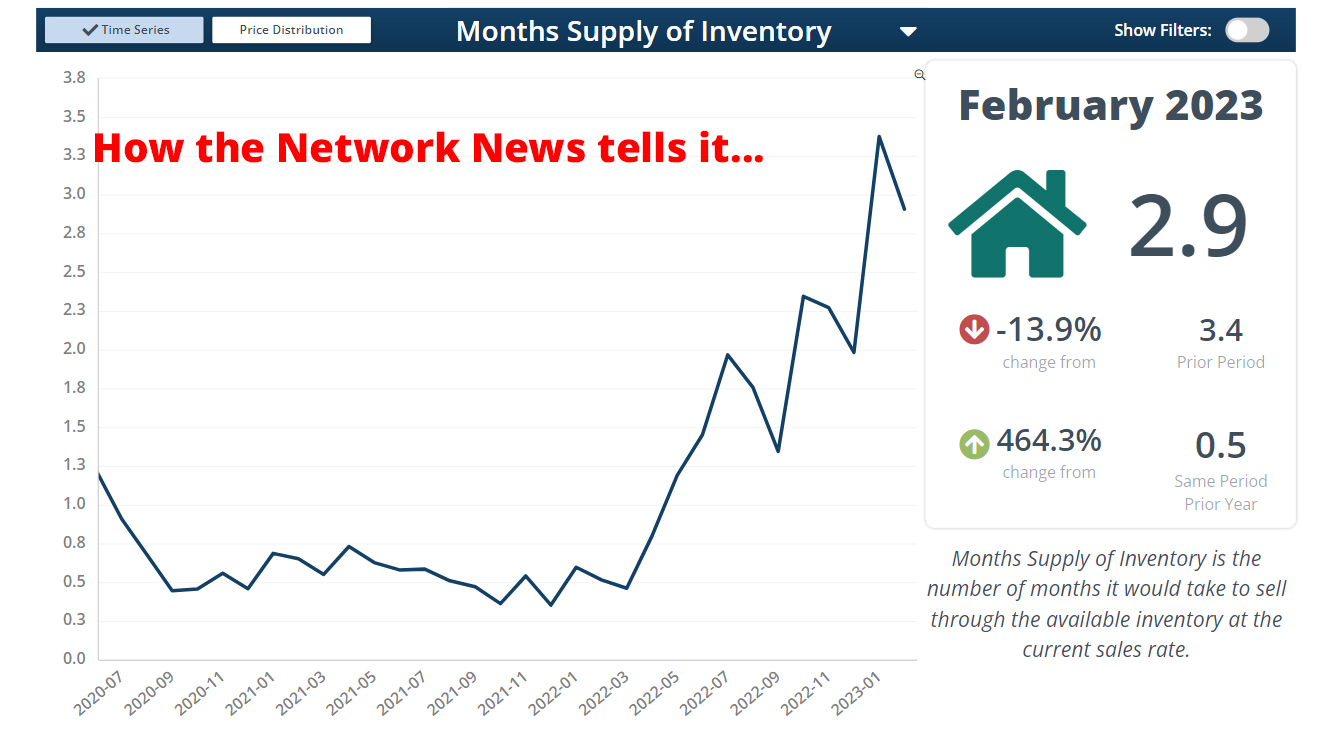

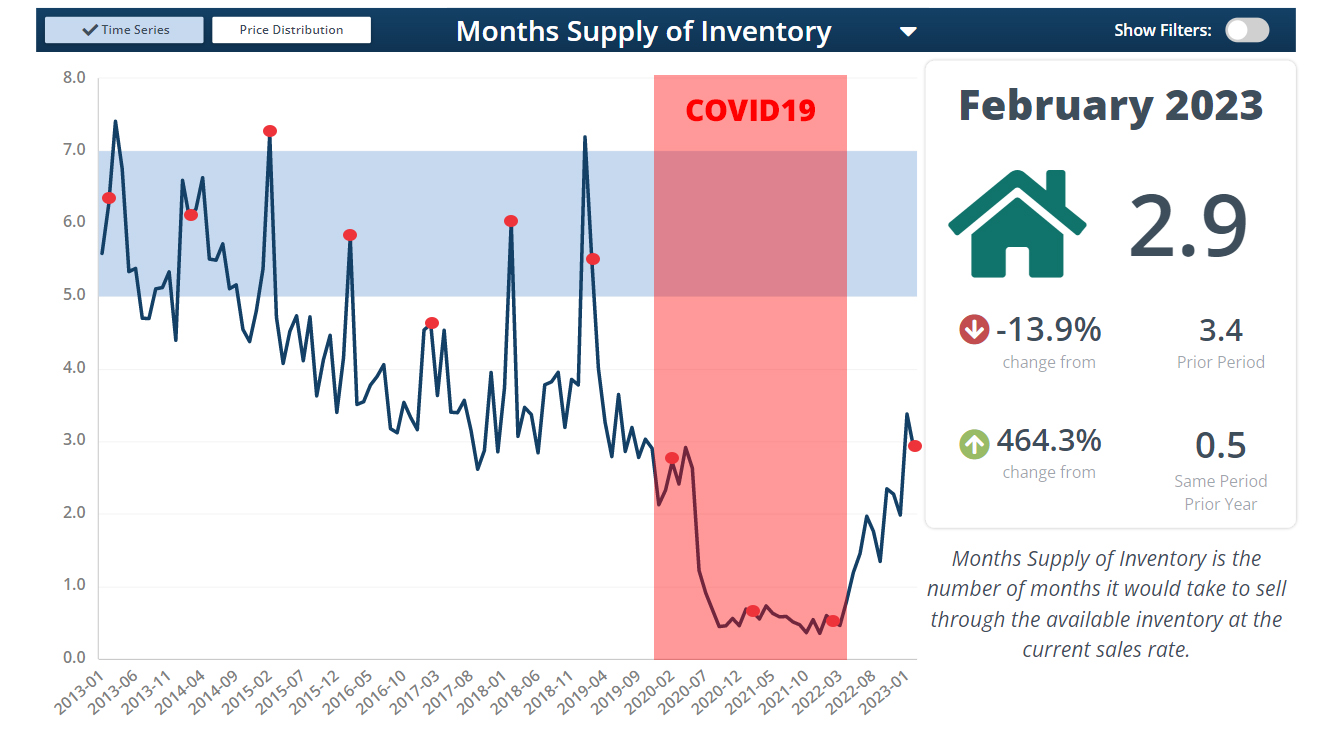

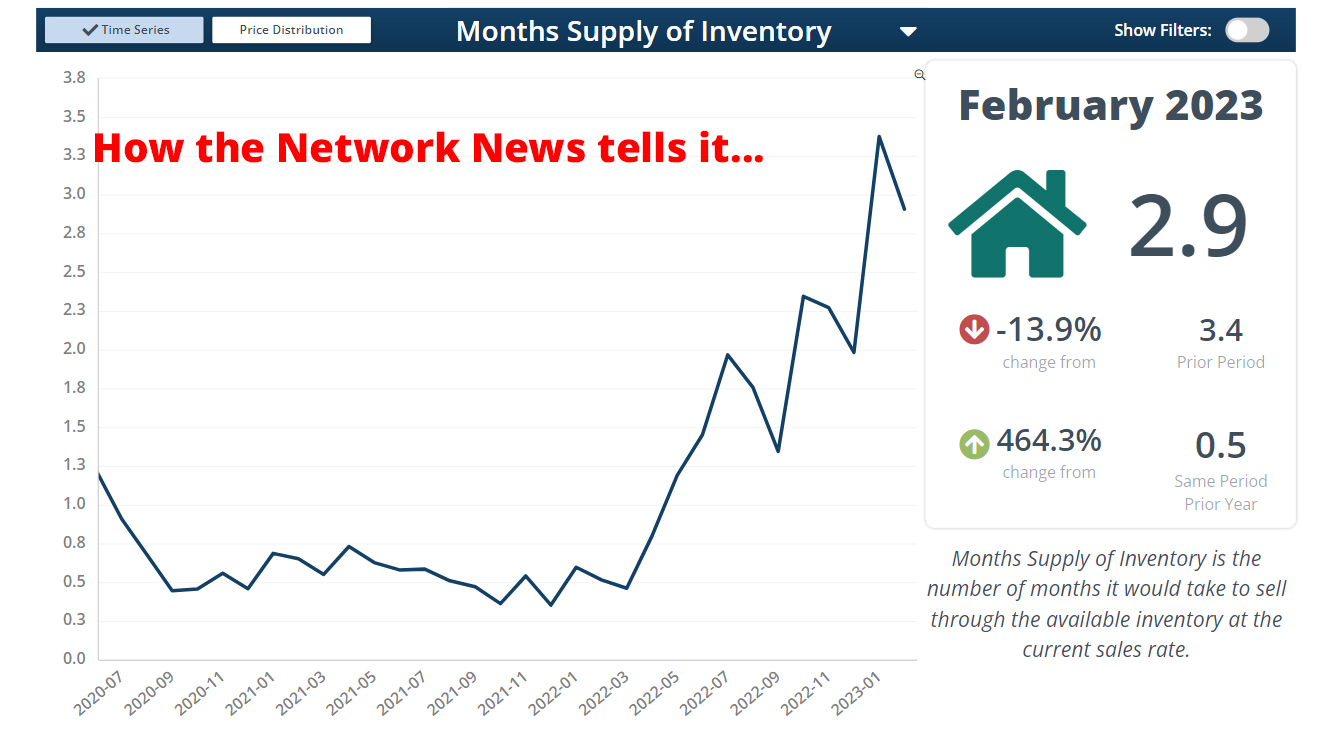

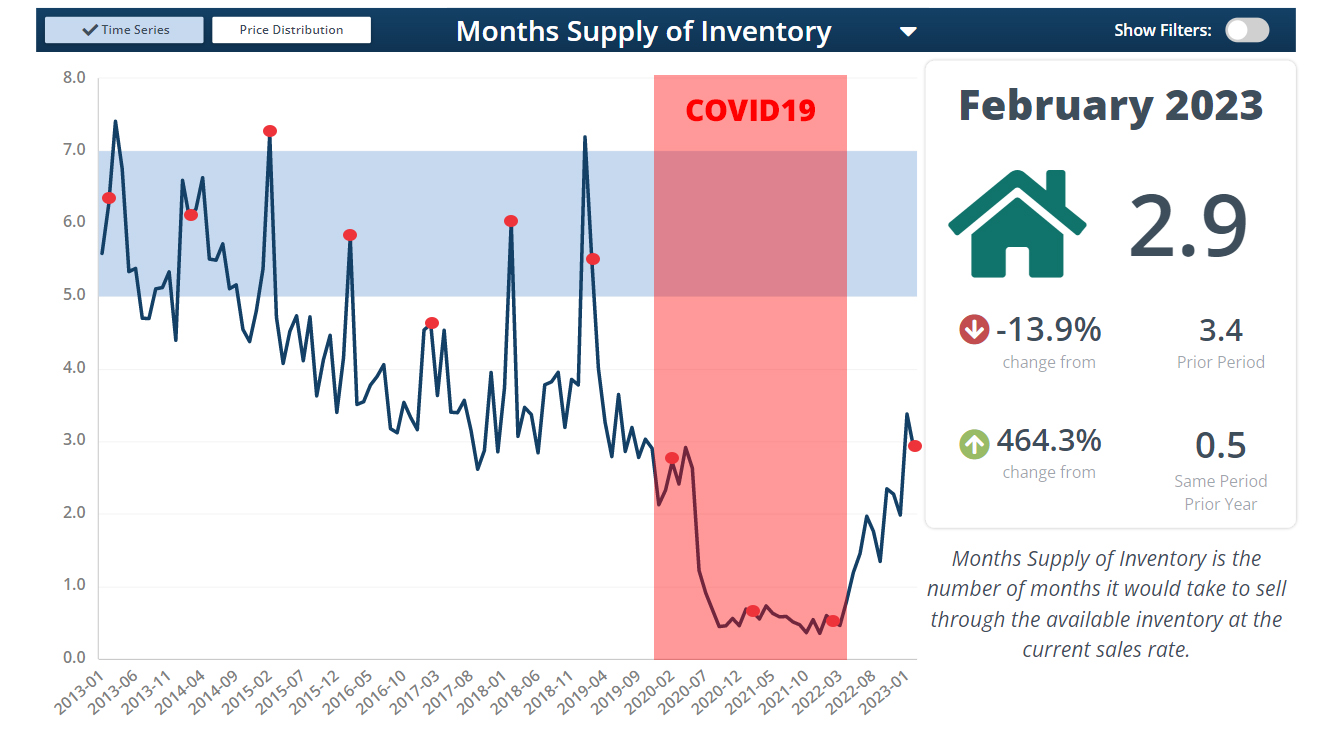

“Month’s Supply of Inventory” is a common way to determine market health. It is calculated by dividing how many homes are currently on the market by how many sold in the last month. If there are 6 months’ worth of homes left to sell, it is considered a balanced market that is neither a Seller’s nor Buyer’s Market. Less than 6 months tends to favor Sellers and more than 6 months tends to favor Buyers. Here is the image the Network News folks are showing you. A dramatic incline in the inventory certainly spells a repeat of the 2006 bubble.

The way the Network News spins it, there is a huge glut of inventory beginning to build up. Keep in mind, these folks are hired to sell ad space, not analyze years of real estate history. Telling the full story here would be boring. First off, 2.9 months of inventory is far less than the 6 months that are considered a balanced market but more, they fail to show that every February, from 2013 through COVID-19, inventory had been between 4.6 and 7.2 months, at or near the peak of inventory for every year. Here is the full picture of the market. Each red dot indicates inventory levels in February. Note, each year (even during the worst of COVID-19) it ramps up toward January and February. There is no news here other than that we are returning to pre-COVID-19 market norms.

You have a choice.

If you are one of the many buyers waiting for the lower rates, be ready to compete against all those buyers when you make your first offer. Sellers will be able to use competing buyers against each other to drive up the price. Another option would be to shop now while the other buyers wait. Win the contract at a lower price and then refinance your loan when the rates improve. There is still time.

If you would like to try to get under contract before everyone else does, let's update your search and check in with your lender for an updated pre-qualification letter. Click here if you would like to get a refresher on the process for buying a home.

Egle & Tyler

Egle Rucci

REALTOR®, ABR, GRI, CRPM

Realty Executives of Flagstaff

C (928) 600-5629 | Off (928) 773-9300

egle@propertiesinflagstaff.com | www.myflaghome.com

Connect with me: Facebook | Twitter | LinkedIn

The best compliment I could get, is a referral from you, your family and friends!

S Tyler Hood

Realty Executives of Flagstaff

15 E. Cherry Ave, Flagstaff, AZ 86001

tyler@propertiesinflagstaff.com

Call or Text: 928-440-0747

Office: 928-773-9300