Realty Executives Midwest

Buying a home is one of the largest financial transactions most people will ever undertake. Agents who are REALTORS® are a trusted source of advice and stand ready to help you navigate your homebuying journey and make the choices that work best for you. NAR’s recent settlement has led to several changes that benefit homebuyers, and we wanted to clearly lay them out for you.

Here is what the settlement means for homebuyers:

Here is what the settlement doesn’t change:

As a home seller, you have a wide range of choices when it comes to listing your home. Agents who are REALTORS® are a trusted source of advice and stand ready to help you navigate this complex process and make the choices that work best for you. NAR’s recent settlement has led to several changes related to broker commissions that benefit sellers, and we wanted to clearly lay them out for you.

Here is what the settlement means for home sellers:

Here is what the settlement doesn’t change:

These settlement practice changes will go into effect August 17. More details about these changes and what they mean can be found at facts.realtor.

Navigating the housing market can be tricky, especially these days. That’s why having an experienced guide when buying or selling a home is so important. The market isn’t exactly straightforward right now, and working with a real estate expert can offer insights and advice that make all the difference.

While today’s market conditions might seem confusing or overwhelming, you don’t have to handle them alone. With a trusted expert leading you through every step, you can navigate the process with the clarity and confidence you deserve.

Contracts – Agents help with the disclosures and contracts necessary in today’s heavily regulated environment.

Experience – In today’s market, experience is crucial. Real estate professionals know the entire sales process, including how it’s changing right now.

Negotiations – Your real estate advisor acts as a buffer in negotiations with all parties, and advocates for your best interests throughout the entire transaction.

Industry Expertise– Knowledge is power in today’s market, and your advisor will simply and effectively explain processes, market conditions, and key terms, translating what they mean for you along the way along the way.

Pricing – A real estate professional understands current real estate values when setting the price of your home or helping you make an offer to purchase one. Pricing matters more than ever right now, so having expert advice will help ensure you’re set up for success.

A real estate agent is a crucial guide through this challenging market, but not all agents are created equal. A true expert can carefully walk you through the whole real estate process, look out for your unique needs, and advise you on the best ways to achieve success.

Finding an expert real estate advisor – not just any agent – should be your top priority if you want to buy or sell a home. As Bankrate says:

“Real estate is very localized, and you want someone who’s extremely knowledgeable about the market in your specific area. You should also look for someone with a successful track record of negotiating and closing deals, preferably for homes similar to the kind you want to buy.”

Like any relationship, it starts with trust. You’ll want to know you can depend on that person to always put you and your best interests first. That means hiring a true professional. As Business Insider explains:

“As long as you’ve properly vetted the agents you’re considering and ensured they have the necessary expertise, it’s ok to go with your gut when making your final decision on which real estate agent you want to work with. You’re going to be working closely with this person, so it’s important to choose an agent you’re comfortable with.”

It’s critical to have an expert on your side who’s well-versed in navigating today’s housing market dynamics. If you’re planning to buy or sell a home this year, connect with a real estate professional who will give you the best advice and guide you along the way.

Source: Keeping Current Matters

Realty Executives Midwest

1310 Plainfield Rd. Ste 2 | Darien, IL 60561

Office: 630-969-8880

E-Mail: experts@realtyexecutives.com

If you’re thinking about selling your house, you should know there are buyers who are ready and able to pay today’s high prices. But they want a home that’s move-in ready. A recent press release from Redfin explains:

“Buyers are still out there and they’re willing to pay today’s high prices, but only if the house is in really good shape. They don’t want to spend extra money on paint or new appliances.”

It makes sense when you think about it. They’re having to pay a lot of money for a house in today’s market. That means they may not be able to easily afford upgrades after they move in. So, if your home is outdated or needs some work, buyers might pass it by or offer a lower price than you were hoping for.

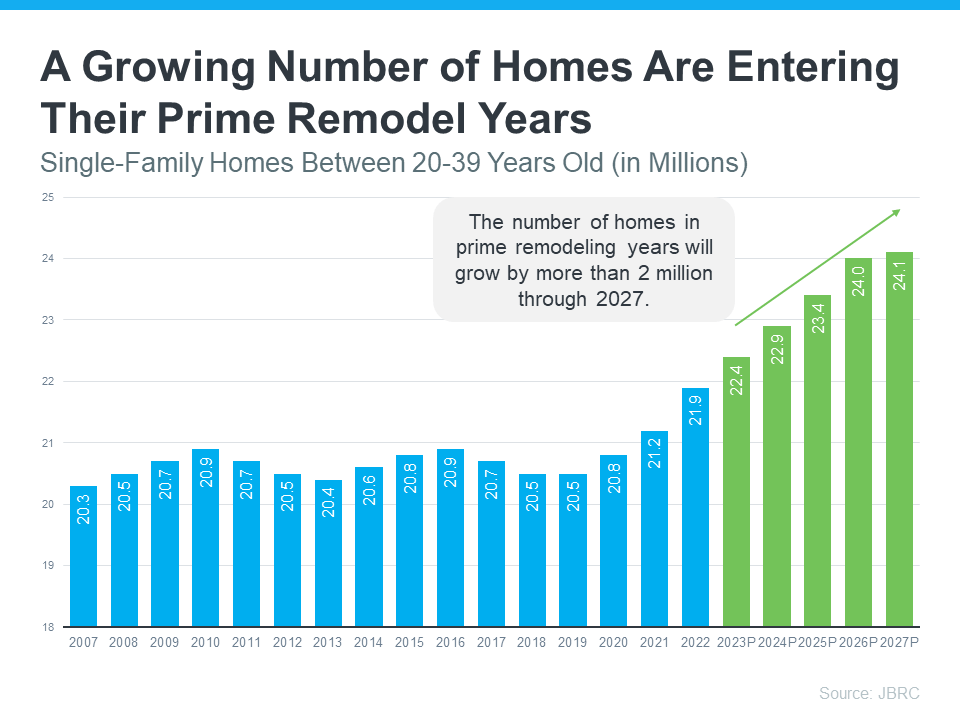

And there are a lot of homes that need upgrades right now. Millions are entering their prime remodel years, meaning they’re between 20 and 39 years old. Maybe yours is one of them. According to John Burns Research and Consulting (JBRC), the number of homes in their prime remodel years is high and growing (see graph below):

If your house falls into this category, it’s important to consider making selective updates to help it appeal to buyers, so it sells faster. But how do you know where to spend your time and money?

By working with a local real estate agent to be strategic about the improvements you make, you can be sure you’re making a smart investment. Put simply, not all upgrades are worth the cost. As Bankrate says:

“Before you spend money on costly upgrades, be sure the changes you make will have a high return on investment. It doesn’t make sense to install new granite countertops, for example, if you only stand to break even on them, or even lose money.”

And, as that same Bankrate article goes on to say, that’s where a local real estate agent comes in:

“. . . a good real estate agent will know what local buyers expect and can help you decide what needs doing and what doesn’t.”

Your agent will know what buyers in your area are looking for and what they’re willing to pay for it. By working together, you can avoid spending money on upgrades that won’t pay off. Instead, they’ll fill you in on which changes will make your house more appealing and valuable.

Selling a house right now requires more than just putting up a For Sale sign. You need to make sure it’s in good condition to attract buyers who are willing to pay today’s high prices.

The way to do that is by making smart improvements that will give you the best return on your investment. Work with a local real estate agent so you know what buyers are looking for and what your house needs before selling.

When you apply for a mortgage, your debt-to-income ratio (DTI) will play a vital role. The mortgage lenders will review your credit profile and check the DTI ratio to assess your affordability. So, the debt-to-income ratio will indicate how much debt you carry, such as credit card balances, payday loans, medical bills, personal loans, and utility bills against your monthly income.

Most borrowers know how much their credit score is, which is essential to show their credit affordability. However, many of us need to learn that, like credit score, the debt-to-income ratio will also affect your mortgage loan or credit approval.

When you take out a loan to buy your residential home, vacation home, or rental home, it will be called a mortgage.

The mortgage interest rate depends on the lender and other factors such as your credit rating, earning levels, and, most importantly, the debt-to-income ratio. Now, let’s discuss how the debt-to-income ratio impacts your ability to get a mortgage.

There are two types of debt-to-income ratios that most lenders accept while reviewing mortgage applications:

As discussed in the introductory paragraph, the lender can assume the risk factor from the DTI ratio before providing a home loan to a borrower. If the borrower’s debt is too high, the borrower can default on the loan amount.

Usually, the lenders follow a rule that the borrower can have a home loan if the DTI ratio is a maximum of 43% of the particular borrower.

So, a borrower who needs a home loan should repay some debt first. This will help the borrower reduce the DTI (debt-to-income) ratio. Thus, the borrower can qualify for a home loan with a favorable interest rate.

Before approving a home loan, lenders check credit scores, which largely depend on the credit utilization ratio. The credit utilization ratio means you have utilized up to what percentage of your credit limit.

Your credit score will be low if you borrow closer to your limit. Thus, your chances of getting approved for a home loan with a favorable interest rate will be lower.

Paying off at least a portion of your credit card debt is a strategy you should adopt. It will help you lower your credit utilization ratio and get approved for a mortgage with a favorable interest rate.

Remember that your income is limited. Manage your spending and card debt payments with this income. With the monthly mortgage loan payment, a new debt burden will be included in your income. Thus, if you pay off the credit card debts, you will have less debt payment on your shoulders.

When you apply for a home loan, the lender will check your credit score and DTI ratio. The interest rate of your home loan will depend on your credit score and the DTI ratio. The lower the lender will offer you an interest rate, the quicker you can pay off the principal balance.

A home buyer should calculate the mortgage loan amount that he or she will have to pay so that he or she may be able to repay the home loan within a definite period.

Fixed-rate mortgage loans are most common among first-time home buyers. A first-time buyer usually takes out this loan for 15 to 30 years. As such, even if the interest rate changes in the market, you will enjoy paying a fixed interest rate on your loan amount.

This is common among home buyers who would like to pay less initially but agree to accept a change in mortgage payment in the future. This change in mortgage payment may either increase or decrease according to the variation in market interest rate. By choosing this type of mortgage loan, the home buyer will have to make a high mortgage payment in the future if, by chance, the interest rate rises suddenly.

With the help of an interest-only mortgage loan, you pay only the interest on the loan amount you’ve taken out for a specific period. During this period, you do not have to pay the principal amount. But once the interest-only period ends, your payment amount increases with the repayment of the principal amount. This loan is helpful for those people who earn money on a commission basis.

Your high debt-to-income ratio may create issues when you apply for a home mortgage. The higher your DTI, the more likely you may face problems. The lender will only entertain your mortgage loan application if you take significant steps to lower it as soon as possible.

So, here are some steps that you may follow to reduce your DTI:

Whether or not you can afford a home loan payment, your lender will come to know about it when they check your credit score and DTI ratio. When you show an impressive credit score and DTI ratio to your lender, chances are you can get a home loan with a favorable interest rate. Thus, paying off your credit card debt before applying for a mortgage is important.

source: Realty Executives

Realty Executives Midwest

1310 Plainfield Rd. Ste 2 | Darien, IL 60561

Office: 630-969-8880

E-Mail: experts@realtyexecutives.com

If you have watched home improvement shows like “Fixer Upper” or “Property Brothers,” you are probably very excited to renovate your home. On TV, home renovations look fast, fun, and exciting. However, working through a renovation as a young homeowner comes with a unique set of challenges.

Renovating your home can be an incredible way to enjoy the space or sell your property for more! But when you renovate your home, you will spend more time on planning, permits and inspections than on choosing a new paint color or decorating.

Here are the top five things you need to know about taking on a renovation as a young homeowner.

According to Forbes, a home renovation in 2024 can cost anywhere from $1,200-$82,000, depending on everything from what materials you use to how much square footage you’re renovating. Since cost is such a crucial factor, planning and budgeting are essential for a successful renovation.

Prioritize your goals, then list all your costs and group them by category. You will need to cover contractors, inspections, permits, materials, and unexpected costs that may arise. Your renovation timeline is also part of your budget since longer projects can cost more to complete.

While planning your renovation, take some time to consider your goals and your neighborhood. What are houses in your neighborhood usually like? How much do they sell for? If your goal is to upgrade before selling, assessing nearby homes can help you hit the right target.

It is also a great idea to talk with people who have gone through a home renovation before. Ask them what their advice is for first-time renovations. What do they wish they had done differently? You can also research common renovation FAQs on YouTube, Google, and online forums like Quora or Reddit.

Before hiring contractors, check their references. Ask them about licensing and their previous experience and talk to several contractors for each kind of project. Although finding the right partners can be time-consuming, in the long run, it will save you time and stress.

Before you start looking for contractors, get familiar with the questions you should ask. With a little research, you will be equipped to sort through your options and find the best fit for your renovation.

Write down your big dream for renovating and remind yourself of it during the process. There are bound to be small frustrations with home renovations, and remembering your end goal will keep you encouraged.

Also keep in mind the importance of safety regardless of how long the project takes- especially in moments of frustration. Renovations inevitably create debris and unsafe environments, so take extra steps to keep your kids and pets safe. Always properly put away tools and safeguard machinery to avoid theft as the National Crime Information Center reports 600 to 1,200 claims of equipment theft each month.

Even with the best plan in place, unexpected changes can always occur during a renovation. Delays due to weather, surprises with structural elements, unplanned costs, and more can all affect the original plan.

It is important to balance research with fluidity. Like a tree that bends in the wind, you can adapt to changes in your renovation without snapping. There is always another solution and a new way forward.

Renovating your home takes time, so do not wait to get started. Use these five tips as a guide to point you in the right direction as you begin your home renovation journey. If you plan carefully, you will be prepared for unexpected setbacks and reach your renovation goals successfully. Pretty soon, you will be the one giving new homeowners renovation advice!

Source: Realty Executives

Realty Executives Midwest

1310 Plainfield Rd. Ste 2 | Darien, IL 60561

Office: 630-969-8880

E-Mail: experts@realtyexecutives.com