Realty Executives Midwest

When you decide to buy your first home, you may come across a number of terms and conditions you’re not familiar with. While you may have a general idea of what an inspection is, maybe you’re not sure why you need one or how it’s different from an appraisal. To keep it simple, here’s an explainer of each one and what they mean for you as a homebuyer.

Once you’re under contract on a home you’d like to buy, getting an inspection is a key part of the process. An inspection gives you a clear idea of the safety and overall condition of the home – which is important for such a big transaction. As a recent Realtor.com article explains:

“A home inspection is something that protects your financial interest in what will likely be the largest purchase you make in your life—one in which you need as much information as possible.”

If anything is questionable in the inspection process – like the age of the roof, the state of the HVAC system, or just about anything else – you have the option to discuss and negotiate any potential issues or repairs with the seller before the transaction is final. And don’t worry – you don’t have to go through that process alone. Your real estate agent will be your advocate and negotiate with the seller for you.

While the inspection tells you about the current state of the house, an appraisal gives you its value. Bankrate explains:

“When buying or selling a home, an appraisal verifies that the sale price of the home is in line with fair market value. This ensures the homebuyer doesn’t pay more than the home is worth, and the mortgage lender doesn’t lend more than it is worth.”

Regardless of what you’re willing to pay for a house, if you’ll be using a mortgage to fund your purchase, the appraisal protects you from overpaying and the bank from lending you more than the home is worth.

And if there’s ever any confusion or discrepancy between the appraisal and the agreed-upon price in your contract, your trusted real estate professional will help you navigate any additional negotiations to try to close the gap.

The inspection and the appraisal are different but equally important steps when buying a home – and you don’t need to manage them by yourself. Connect with an agent today so you have expert guidance from start to finish.

Source: Keeping Current Matters

Realty Executives Midwest

1310 Plainfield Rd. Ste 2 | Darien, IL 60561

Office: 630-969-8880

E-Mail: experts@realtyexecutives.com

Fannie Mae on Friday slashed its 2024 forecast as a result of weak spring home sales, but listings are returning to the market and mortgage rates look poised to drop, according to new projections.

Author: Matt Carter, Inman News

A weaker-than-expected spring has prompted Fannie Mae economists to cut their forecast for 2024 home sales, to the point where it’s now looking like this year will hardly be better than last year.

But more listings are starting to come onto the market — particularly in the Sun Belt — and the economy is cooling at a pace that should help mortgage rates stay on their current downward trajectory, economists at the mortgage giant said Friday.

“The economy appears to be slowing, and recent readings offer hope that inflation is cooling after progress on that front stalled in the first quarter – a trend that will likely need to be sustained for the Fed to feel comfortable cutting rates,” Fannie Mae Chief Economist Doug Duncan said in a statement. “Additionally, the labor market is showing signs of a gradual slowdown, with the unemployment rate creeping up to 4 percent in the June report.”

But home sales won’t pick up until there’s “some combination of continued household income growth, a further slowing of home price appreciation, or a decline in mortgage rates to bring affordability within range of many waiting first-time and move-up homebuyers,” Duncan said.

Sales of existing homes fell 1.9 percent in April, to an annualized pace of 4.14 million.

“This was somewhat weaker than we had anticipated, and recent purchase mortgage application data also point to near-term weakness,” Fannie Mae economists said in commentary accompanying their latest forecast. “As such, we have downwardly revised our existing home sales outlook and now project 2024 existing sales to total 4.15 million (previously 4.20 million). This now represents only a minor increase of 1.5 percent from 2023 total year existing sales.”

That near-term weakness was confirmed Friday with the release of the latest existing home sales data for May from the National Association of Realtors, which showed sales fell for the third month in a row, to a seasonally adjusted annual rate of 4.11 million.

“This sales softness is happening while listings continue to rise. We read this divergence to mean more homeowners are no longer putting off their decision to sell, despite the so-called ‘lock-in effect,’ perhaps out of a belief that mortgage rates will remain higher for longer,” Fannie Mae economists said. “However, affordability constraints are limiting the number of buyers willing and able to purchase these homes.

Home prices are often “sticky” on the way down, but a “gradual loosening” of inventory is likely to decelerate home price growth, Fannie Mae economists predicted.

NAR put the months supply of inventory at 3.5 in April, up from 3.0 months a year ago. And while the numbers for May were too late for Fannie Mae forecasters to incorporate into their forecast, months supply of inventory was up again last month, to 3.7 months, NAR reported.

But those are national numbers, and Fannie Mae forecasters noted there’s a “strong geographic skew” to recent listings growth.

“Many of the previously hot Sun Belt markets are where listings are disproportionately rising. These metros also tend to be markets with a higher degree of new construction in recent years, and now some of them have for-sale inventory levels similar to 2019.”

Close to half of the total growth in listings nationwide over the last year can be chalked up to Florida and Texas.

“This suggests that these markets will experience comparative price softness going forward while supply remains comparatively tight in many of the northeast and midwestern markets,” Fannie Mae economists said.

For now, the scarcity of existing homes in many markets is helping prop up new home construction and sales.

But sales of new homes dipped 4.7 percent from March to April, to a seasonally adjusted annual rate of 634,000. That’s a 7.7 percent decline from a year ago.

With a 9.1 month supply of new homes on the market in April — the highest since November 2022 — Fannie Mae economists have lowered their expectations for new home sales in Q2 2024 and Q3 2024.

Fannie Mae now expects 2024 new home sales stay flat from a year ago at 667,000, but grow by 13 percent next year.

Easing mortgage rates are expected to help boost sales of existing homes by 9 percent next year, to 4.51 million.

Source: Fannie Mae Housing Forecast, June 2024; MBA Mortgage Finance Forecast, May 2024.

Recent economic data, including the Consumer Price Index (CPI) and Producer Price Index (PPI) coming in cooler in May than recent months, has Fannie Mae economists regaining confidence that mortgage rates have room to come down this year.

“This welcome news on the inflation front led to a significant drop in the 10-year Treasury rate and an increase in the odds of rate cuts this year,” Fannie Mae forecasters said.

Last month, Fannie Mae forecasters predicted rates on 30-year fixed-rate loans wouldn’t drop below 7 percent this year, and would still be averaging 6.6 percent in Q4 2025.

With mortgage rates already under 7 percent, Fannie Mae is forecasting that 30-year fixed-rate loans will drop to 6.7 percent during Q4 2024, and to 6.3 percent by the end of next year.

In their most recent forecast, released May 16, economists at the Mortgage Bankers Association envisioned a steeper decline, with 30-year fixed-rate loans hitting 6.5 percent by the end of this year, and dropping below 6 percent in the final three months of next year.

While Fannie Mae economists don’t expect the Fed to cut rates until December, “additional soft inflation reports, especially if combined with a growing acceptance that payroll employment is perhaps overstated, makes a September cut still a real possibility.”

The Federal Reserve’s preferred inflation gauge, the Personal Consumption Expenditures (PCE) price index, is set to be updated on June 28.

Source: Fannie Mae Housing Forecast, June 2024.

Diminished expectations for home sales mean Fannie Mae forecasters now expect purchase mortgage volume to total $1.3 trillion in 2024, $20 billion less than last month’s forecast.

But thanks to rising home prices, that would still represent 10 percent growth from the $1.22 trillion in purchase mortgages originated last year.

As mortgage rates come down and home price appreciation decelerates next year, Fannie Mae projects purchase mortgage originations will grow by an even stronger 14 percent in 2025, to $1.5 trillion.

The steeper glide path Fannie Mae economists now envision for mortgage rates is expected to translate into an additional $4 billion in refinancing volume this year and next when compared to last month’s forecast.

Refinance volumes are now expected to grow by 50 percent this year, to $372 billion, and by 46 percent next year, to $544 billion.

Source: https://www.inman.com/2024/06/24/more-listings-lower-rates-should-boost-2025-sales-fannie-mae/

Summer is a beautiful season to enjoy long days, warm weather, and outdoor activities. However, it is also an ideal time to tackle some essential home maintenance tasks. Proper summer home maintenance enhances your home’s appearance and ensures everything runs smoothly and efficiently. Here are seven summer home maintenance tips to keep your home in shape.

Nothing beats the relief of a cool home on a hot summer day. Schedule a professional HVAC inspection to ensure the air conditioning system in your home is prepared to handle the heat. Regular maintenance can prevent unexpected breakdowns and improve energy efficiency. Clean or replace air filters, check for refrigerant leaks, and ensure the thermostat works correctly.

Summer storms can bring heavy rain, wreaking havoc on your gutters. Clean out any debris, leaves, or twigs that may have accumulated during the spring. Inspect for any signs of sagging or damage and make the necessary repairs. Well-functioning gutters prevent water damage to your roof, siding, and foundation.

Windows and doors are vital areas where energy loss can occur. Check for any drafts and apply weather-stripping or caulk to seal gaps. Clean the windows inside and out to allow enough natural light and improve your home’s overall appearance. If any screens are damaged, replace them to keep bugs out while enjoying the summer breeze.

The exterior of your home faces a lot of wear and tear from the weather changes. Inspect your home’s exterior paint for any peeling or chipping. Freshly painted siding is protected from moisture and sun damage while boosting curb appeal. Select a good-quality paint that can withstand the summer heat and humidity.

Your roof is your home’s first line of defense against the elements. Summer is a great time to inspect it for possible signs of damage, such as leaks, missing shingles, or cracks. Attending to these issues early can prevent eventual costly repairs. If necessary, hire a professional roofer to inspect thoroughly and repair.

Outdoor spaces like decks and patios are perfect for summer gatherings. To keep them looking their best, clean and seal your deck to protect it from the sun and rain. Remove any dirt, mold, or mildew, and check for loose boards or nails. Power wash the surface of patios and inspect for any cracks or damage. Consider applying a sealant to protect against future wear and tear.

A well-maintained garden and landscape can enhance the beauty of your home and provide a relaxing outdoor environment. Trim overgrown bushes, trees, and shrubs to prevent them from encroaching on your home.

Mow the lawn regularly, water plants early in the morning or late evening to minimize evaporation, and add mulch to retain moisture and suppress weeds. Also, consider installing a drip irrigation system to conserve water and ensure your plants get the hydration they need.

Summer can bring extreme weather conditions, including storms and hurricanes in some areas. Ensure your home is prepared with an emergency kit including essentials like water, non-perishable food, flashlights, batteries, and a first-aid kit. Create a family emergency plan and make sure everyone knows the steps to take in case of a disaster.

Taking the time to perform these summer maintenance tasks can save you money, prevent costly repairs, and enhance the comfort and safety of your home. Enjoy a worry-free summer by keeping your home in top condition and ready to handle whatever the season brings.

Source: Realty Executives

Realty Executives Midwest

1310 Plainfield Rd. Ste 2 | Darien, IL 60561

Office: 630-969-8880

E-Mail: experts@realtyexecutives.com

Many homeowners looking to sell feel like they’re stuck between a rock and a hard place right now. Today’s mortgage rates are higher than the one they currently have on their home, and that’s making it harder to want to sell and make a move. Maybe you’re in the same boat.

But what if there was a way to offset these higher borrowing costs? There is. And the money you need probably already exists in your current home in the form of equity.

Think of equity as a simple math equation. Freddie Mac explains:

“. . . your home’s equity is the difference between how much your home is worth and how much you owe on your mortgage.”

Your equity grows as you pay down your loan over time and as home prices climb. And thanks to the rapid home price appreciation we saw in recent years, you probably have a whole lot more of it than you realize.

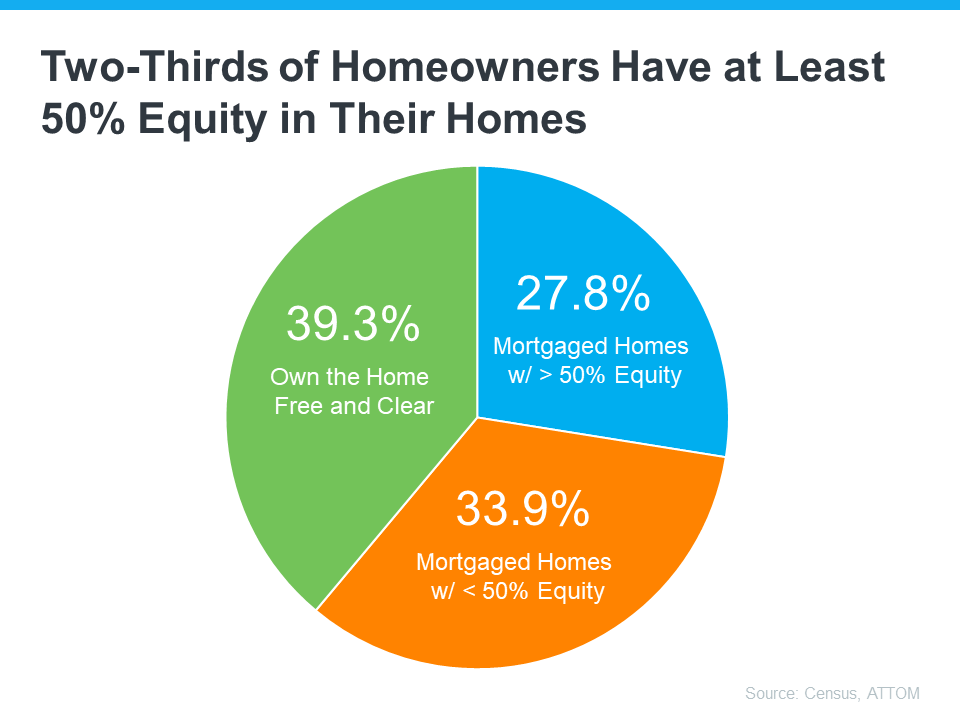

The latest from the Census and ATTOM shows more than two out of three homeowners have either completely paid off their mortgages (shown in green in the chart below) or have at least 50% equity (shown in blue in the chart below):

That means the majority of homeowners have a game-changing amount of equity right now.

After you sell your house, that equity can help you move without worrying as much about today’s mortgage rates. As Danielle Hale, Chief Economist for Realtor.com says:

“A consideration today’s homeowners should review is what their home equity picture looks like. With the typical home listing price up 40% from just five years ago, many home sellers are sitting on a healthy equity cushion. This means they are likely to walk away from a home sale with proceeds that they can use to offset the amount of borrowing needed for their next home purchase.”

To give you some examples, here are a few ways you can use equity to buy your next home:

Want to find out how much equity you have? To do that, you’ll need two things:

You can probably find the mortgage balance on your monthly mortgage statement. To understand the current market value of your house, you can pay hundreds of dollars for an appraisal, or you can contact a local real estate agent who will be able to present to you, at no charge, a professional equity assessment report (PEAR).

Once you’ve connected with a trusted local agent and run the numbers, you’re one step closer to making a move you may not have thought was realistic – all thanks to your equity.

If you want to find out how much equity you have and talk more about how it can make your next move possible, connect with a local real estate professional.

Source: Keeping Current Matters

Realty Executives Midwest

1310 Plainfield Rd. Ste 2 | Darien, IL 60561

Office: 630-969-8880

E-Mail: experts@realtyexecutives.com