Wood & Angevine Real Estate Team

Broker/Realtor

Realty Executives St. Louis

Over the past few years, some homeowners have decided to delay their move because they don’t want to sell and take on a higher mortgage rate on their next home. Maybe you’re thinking the same thing. And honestly, that’s no surprise. It’s a very common roadblock and is one of the biggest factors that’s kept the number of homes on the market so low for so long.

But a growing number of homeowners are deciding they just can’t wait any longer. Often, it’s because of personal or lifestyle change. As Redfin explains:

“Some homeowners are opting to bite the bullet and give up their low rate in order to move. Many are selling because a major life event like a job change, or divorce . . .”

If you’re weighing the decision to move, take a look at some of the top reasons others are choosing to sell. You might find those are reason enough for you to move now, too.

A new job in a different city, a desire to be closer to family, or simply wanting a change of scenery can all spark the need to sell.

Let’s say you’ve landed a great job offer that requires relocating, listing your current home quickly may be the next logical step.

Sometimes, your current home just doesn’t fit your lifestyle anymore. A growing family, the need for a home office, or more room for entertaining can all drive the decision to upgrade to a larger space.

As an example, if you live in a condo and have a baby on the way, selling might be the next best move so you can find a larger home that suits your needs.

On the flip side, some homeowners are ready to downsize. This could be due to children moving out, retirement, or simply wanting less to maintain.

If you’re newly retired and dreaming of a simpler lifestyle, downsizing to a smaller home could free up both time and resources to enjoy this new chapter of life.

Big changes like divorce, separation, or marriage often lead to a need for new living arrangements.

If you just went through a divorce, selling the house you once shared may allow both of you to move forward and find a living situation that works better for you now.

Health concerns, especially those that affect mobility, can also drive the decision to sell. A home that once worked well might no longer suit your needs.

If this sounds like your experience right now, selling your current home to move into a more accessible space, or even using the proceeds for assisted living, could significantly improve your quality of life.

Selling your home isn’t just about market conditions or mortgage rates—it’s also about making the best decision for your lifestyle and future. As Bankrate says:

“Deciding whether it’s the right time to sell your home is a very personal choice. There are numerous important questions to consider, both financial and lifestyle-based . . . Your future plans and goals should be a significant part of the equation.”

If a major life change has you thinking about moving, now might still be the right time to sell. Let’s connect so you have an expert to help you navigate the process.

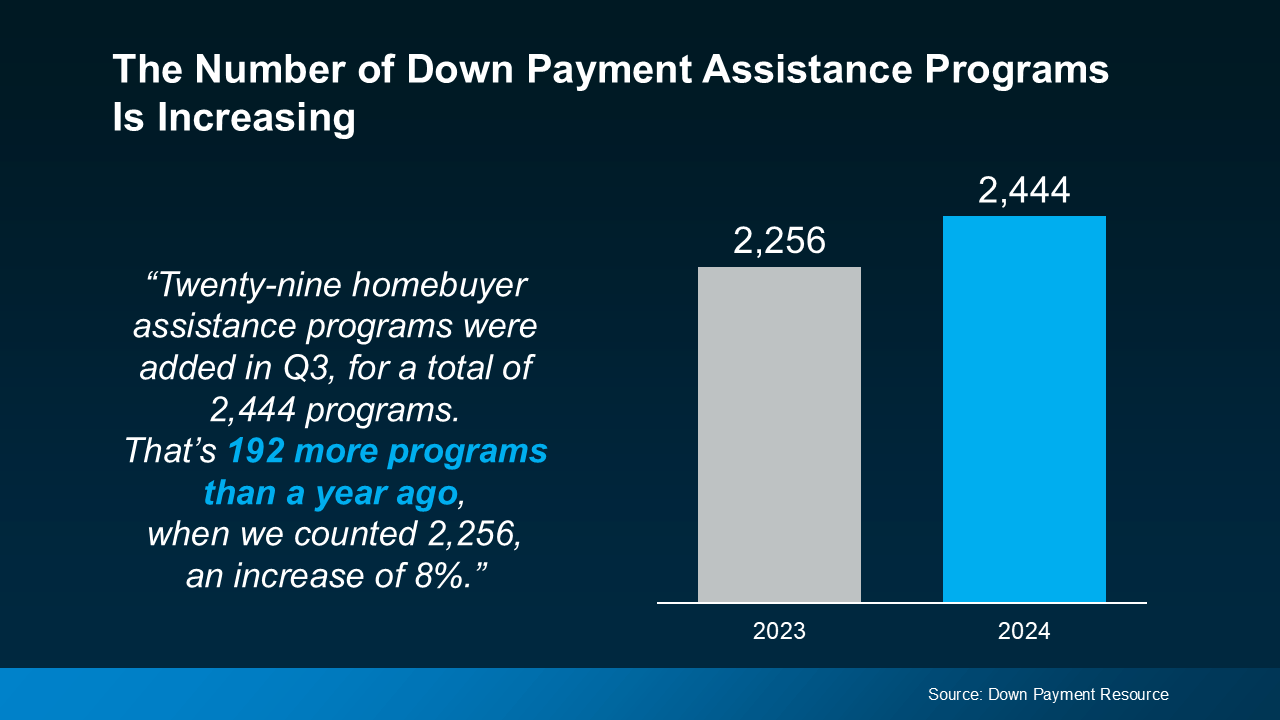

With rising home prices and volatile mortgage rates, it’s important you know about every resource that could help make buying a home possible. And one thing you’ll want to be aware of is just how much the number of down payment assistance (DPA) programs has grown lately.

Take a look at the graph below to see how many new programs have been added in the last year, according to data from Down Payment Resource:

So, what does this increase mean for you? With more programs available, there’s a higher likelihood that one of them could help you reach your homeownership goals.

And these programs aren’t small-scale help either – the benefits can go a long way toward covering a chunk of your costs. As Rob Chrane, Founder and CEO of Down Payment Resource, shares:

"We are pleased to see a growing number of these programs, and think they are becoming a targeted way to help first-time and first-generation homebuyers struggling to save for a down payment get into a home they can afford. Our data shows the average DPA benefit is roughly $17,000. That can be a nice jump-start for saving for a down payment and other costs of homeownership.”

Imagine being able to qualify for $17,000 toward your down payment—that’s a big boost, especially if you’re looking to buy your first home. With that level of help, buying a home may be more within reach than you think.

But it’s worth calling out that the growth in DPA options isn’t just focused on first-time and first-generation buyers. Many of the new programs are also aimed at supporting affordable housing initiatives, which include manufactured and multi-family homes. This means that more people, and a wider variety of home types, can qualify for down payment assistance, making it easier for you to find an option that fits your needs.

With so many DPA programs out there, you need to make sure you’re finding the right one for you. That’s why it’s key to lean on your real estate and lending professionals for guidance. The Mortgage Reports says:

“The best way to find down payment assistance programs for which you qualify is to speak with your loan officer or broker. They should know about local grants and loan programs that can help you out.”

Your loan officer or real estate agent will know what’s available in your area and can point you toward programs that align with your goals.

With more down payment assistance programs than ever before, now’s a great time to explore how these options can help on your homebuying journey. Let’s work together to make sure you’ve got a team of expert advisors in place to see which DPA programs could be a fit for you.

If you’re debating whether or not you want to sell right now, it might be because you’ve got some unanswered questions, like if moving really makes sense in today's market. Maybe you’re wondering if it’s even a good idea to move right now. Or you’re stressed because you think you won't find a house you like.

To put your mind at ease, here’s how to tackle these two concerns head-on.

If you own a home already, you may have been holding off because you don’t want to sell and take on a higher mortgage rate on your next house. But your move may be a lot more feasible than you think, and that’s because of your equity.

Equity is the current market value of your home minus what you still owe on your loan. And thanks to the rapid appreciation we saw over the past few years, your equity has gotten a big boost. Just how much are we talking about? See for yourself. As Dr. Selma Hepp, Chief Economist at CoreLogic, explains:

“Persistent home price growth has continued to fuel home equity gains for existing homeowners who now average about $315,000 in equity and almost $129,000 more than at the onset of the pandemic.”

Here’s why this can be such a game-changer when you sell. You can use that equity to put down a larger amount on your next home, which means financing less at today’s mortgage rate. And in some cases, you may even be able to buy your next home in cash, avoiding mortgage rates altogether.

The bottom line? Your equity could be the key to making your next move possible.

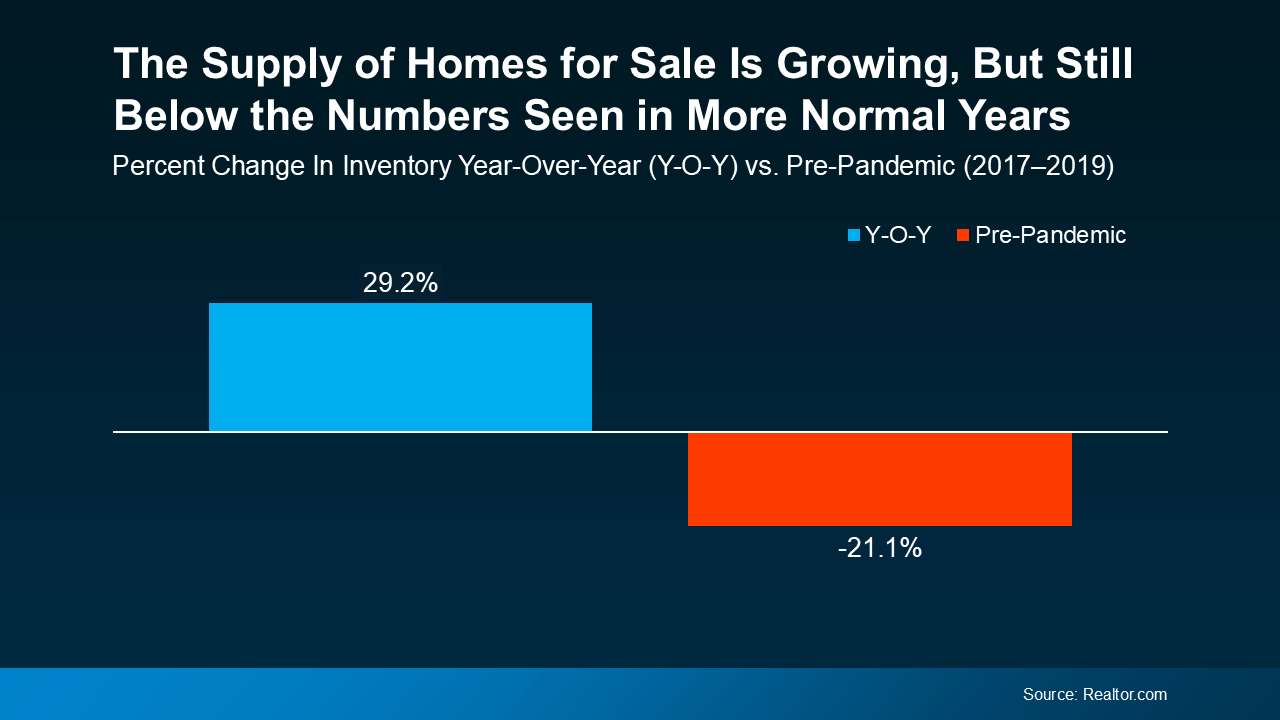

If this is on your mind, it’s probably because you remember just how low the supply of homes for sale got over the past few years. It felt nearly impossible to find a home to buy because there were so few available.

But finding a home in today’s market isn’t as challenging. That’s because the number of homes for sale is growing, giving you more options to choose from. Data from Realtor.com shows just how much inventory has increased – it's up almost 30% year-over-year (see graph below):

And even though inventory is still below pre-pandemic levels, this is the highest it’s been in quite a while. That means you have more options for your move, but your house should still stand out to buyers at the same time. That’s a sweet spot for you.

And even though inventory is still below pre-pandemic levels, this is the highest it’s been in quite a while. That means you have more options for your move, but your house should still stand out to buyers at the same time. That’s a sweet spot for you.

It’s important to note, though, that this balance varies by local market. Some places may have more homes for sale than others, so working with a local real estate agent is the best way to see what inventory trends look like in your area.

If you’re thinking about selling, hopefully these concerns haven’t kept you up at night. With this information, you should realize you don’t have to let the what-if’s delay your move anymore.

Let’s connect so you have the data and the local perspective you need to move forward.

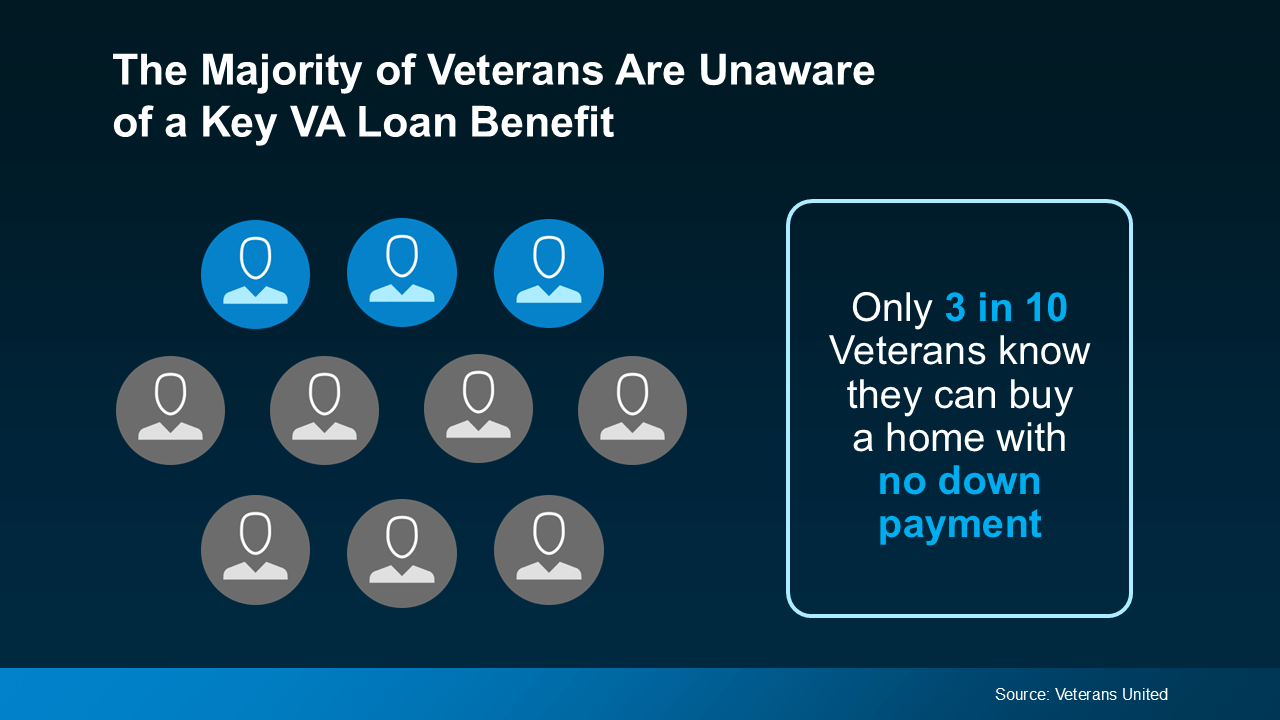

For over 79 years, Veterans Affairs (VA) home loans have helped countless Veterans achieve the dream of homeownership. But according to Veterans United, only 3 in 10 Veterans realize they may be able to buy a home without needing a down payment (see visual below):

That’s why it’s so important for Veterans – and anyone who cares about a Veteran – to be aware of this valuable program. Knowing about the resources available can make the path to homeownership easier and keep life-changing plans from being put on hold. As Veterans United explains:

That’s why it’s so important for Veterans – and anyone who cares about a Veteran – to be aware of this valuable program. Knowing about the resources available can make the path to homeownership easier and keep life-changing plans from being put on hold. As Veterans United explains:

"The ability to buy with 0% down is the signature advantage of this nearly 80-year-old benefit program. Eligible Veterans can buy as much house as they can afford, all without the need to spend years saving for a down payment."

VA home loans are designed to make homeownership a reality for those who have served our country. These loans come with the following benefits according to the Department of Veterans Affairs:

Your team of expert real estate professionals, including a local agent and a trusted lender, are the best resource to understand all the options and advantages available to help you achieve your homebuying goals.

Owning a home is a key part of the American Dream, and VA home loans are a powerful benefit for those who’ve served our country. Let’s connect to make sure you have everything you need to make confident decisions in the housing market.

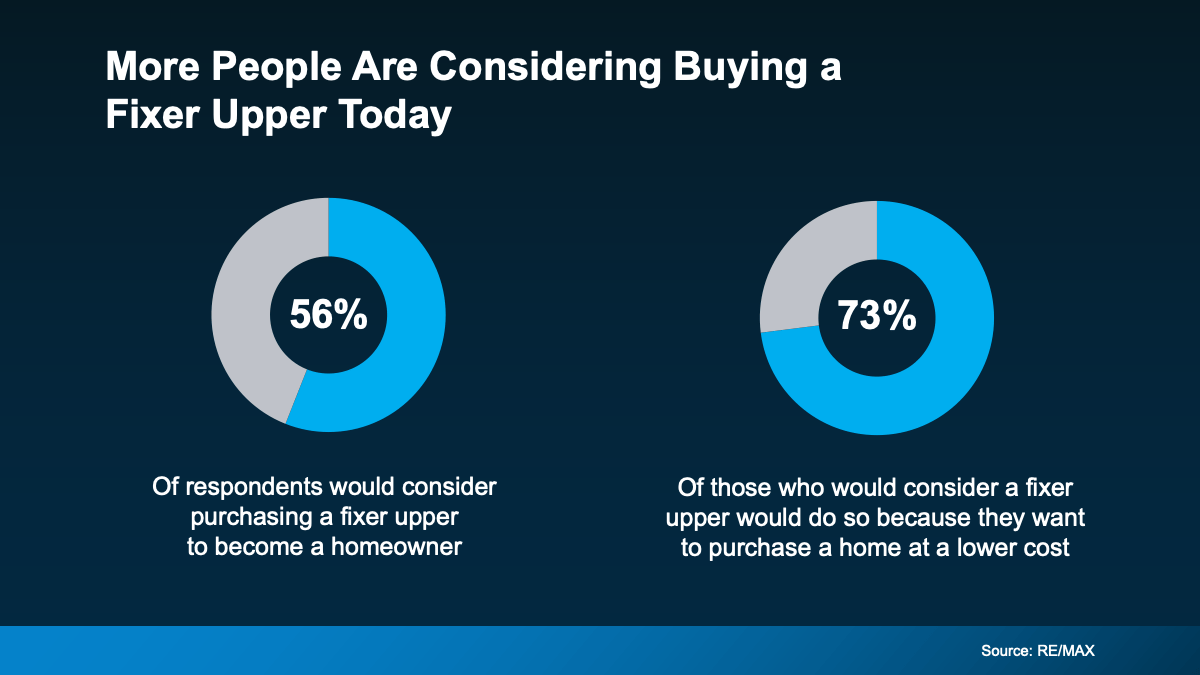

Looking to buy a home but feeling like almost everything is out of reach? Here’s the thing. There’s still a way to become a homeowner, even when affordability seems like a huge roadblock – and it might be with a fixer upper. Let’s dive into why buying a fixer upper could be your ticket to homeownership and how you can make it work.

A fixer upper is a home that’s in livable condition but needs some work. The amount of work varies by home – some may need cosmetic updates like wallpaper removal and new flooring, while others might require more extensive repairs like replacing a roof or updating plumbing.

Because they need some elbow grease, these homes typically have a lower price point, based on local market value. In fact, a survey from StorageCafe explains that fixer uppers generally cost about 29% less than move-in-ready homes.

And that’s why, according to a recent survey, more buyers are considering homes that need a little extra work right now (see below):

If you're looking for an option to get your foot in the door, and you're willing to roll up your sleeves and do a bit of work, a house with untapped potential may be a good option.

If you're looking for an option to get your foot in the door, and you're willing to roll up your sleeves and do a bit of work, a house with untapped potential may be a good option.

Before you buy a home that may need a makeover, here are a few things to keep in mind:

Remember, the perfect home is the one you perfect after buying it. By starting with a fixer upper, you have the opportunity to customize a home to your liking while saving money on the initial purchase price. With careful planning, budgeting, and a little bit of vision, you can turn a house that needs some love into your perfect home.

Real estate agents are great at finding homes with potential. They know the local market and can guide you to homes where smart upgrades can add value. With their help, you’re more likely to find a house that fits your total budget and has room for worthwhile improvements.

In today’s market, where the cost of homeownership can be intimidating, finding a move-in-ready home that fits your budget can feel like a real challenge. But if you’re open to putting in a little work, you can transform a fixer upper into your ideal home over time. Let’s explore what’s possible and find a place that'll work for you.