Realty Executives Midwest

Whether it’s at a family gathering, your company party, or catching up with friends over the holidays, the housing market always finds its way into the conversation.

Here are the top three questions on a lot of people’s minds this season, and straightforward answers to help you feel more confident about the market.

Yes, more than you could a year or two ago.

The number of homes for sale has been rising over the past few years. According to data from Realtor.com, there have been more than one million homes on the market for six straight months, something that hasn’t happened since 2019 (see graph below):

Many homeowners who held off are realizing the shelves aren’t bare anymore. So, if you hit pause on your home search last year because nothing fit your needs, it may be worth another look. With more homes on the market now, you’re not competing for the same handful of listings like you were a couple of years ago.

And because there’s a bit more to choose from, homes aren’t disappearing the minute they hit the market. That gives buyers more space to breathe, more options to compare, and a little more time to make a confident decision.

Affordability is starting to improve. Finally.

It’s been a tough few years for buyers. But this year brought some much-needed good news:

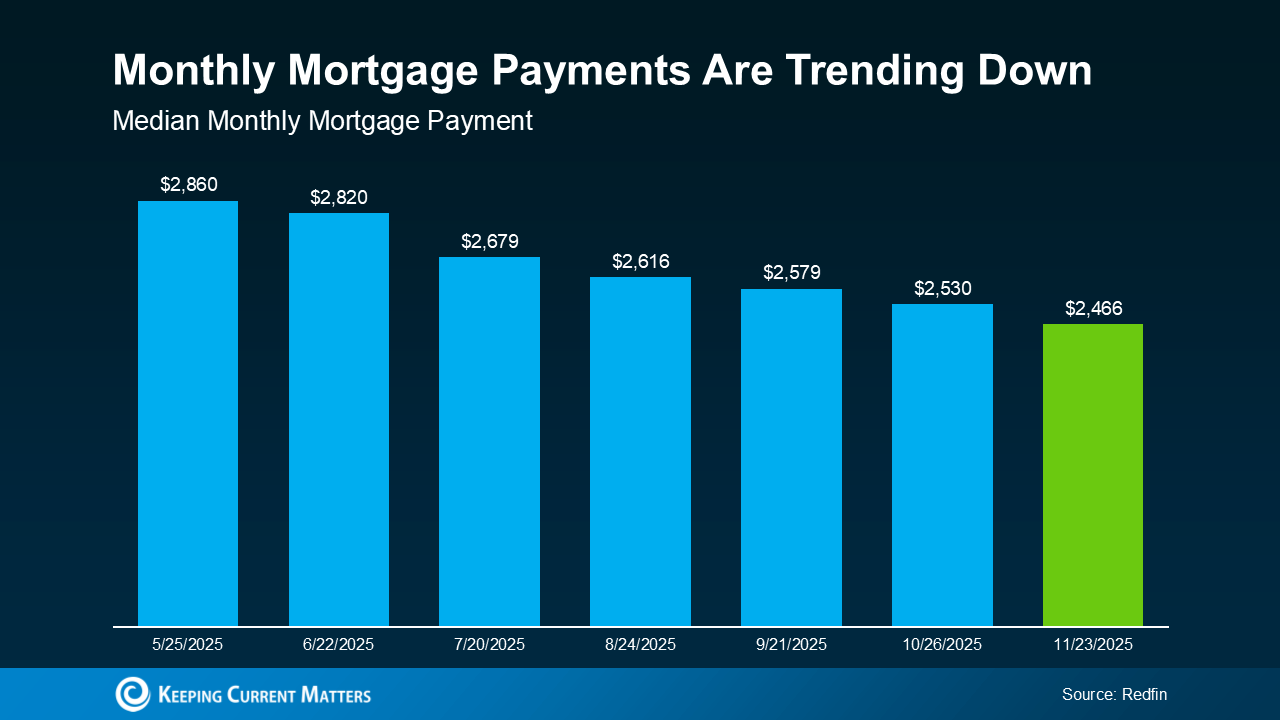

That adds up to a monthly mortgage payment that’s hundreds of dollars lower than it would have been just a few months ago (see graph below):

Buying still isn’t easy, but the numbers are starting to improve. For a lot of people, that means buying a home is becoming a more realistic goal again.

Buying still isn’t easy, but the numbers are starting to improve. For a lot of people, that means buying a home is becoming a more realistic goal again.

A lot of people worry that the housing market is about to crash, but the data doesn’t point in that direction. Yes, the number of homes for sale has been rising, but it’s still nowhere near the level needed for prices to fall significantly on a national scale. On top of that, homeowners today have a lot of equity and are in a much stronger financial position than they were back in 2008.

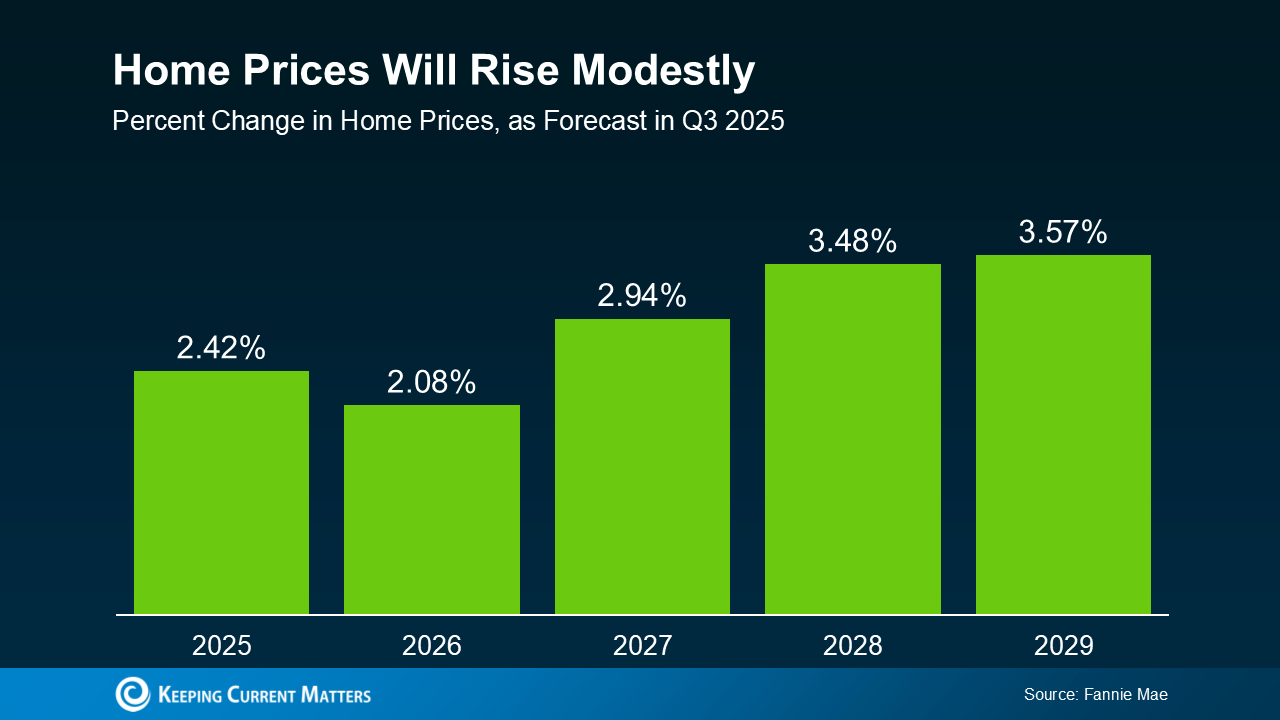

Of course, every local market is a little different. Some areas are still seeing prices climb, while others that saw huge spikes a few years ago are leveling off or seeing small corrections. But overall, the national picture is clear: experts surveyed by Fannie Mae project home prices will keep rising, just at a slower, more normal pace (see graph below):

That’s why waiting for a major price drop to get a deal isn’t a very strategic plan. History shows the same thing over and over: people who spend time in the market tend to build the most long-term wealth, not the people who try to time the market perfectly.

That’s why waiting for a major price drop to get a deal isn’t a very strategic plan. History shows the same thing over and over: people who spend time in the market tend to build the most long-term wealth, not the people who try to time the market perfectly.

Talk about the housing market can feel loud and confusing, especially when you’re hearing so many different takes. A trusted local agent can help you make sense of the data and understand your options. If you’re thinking about buying or selling, reach out to a local professional.

Source: Keeping Current Matters

Realty Executives Midwest

1310 Plainfield Rd. Ste 2 | Darien, IL 60561

Office: 630-969-8880

E-Mail: experts@realtyexecutives.com

Want to know how to find the best deal possible in today’s housing market? Here’s the secret. Focus on homes that have been sitting on the market for a while.

Because when a listing lingers, sellers tend to get more realistic – and, more willing to negotiate. And that’s where the savviest buyers are finding homes other buyers overlook.

According to Realtor.com, about 1 in every 5 listings (20.2%) have dropped their asking price at least once. And while so many things in today’s housing market vary by region, that number is consistent throughout the country. That tells you one thing…

No matter where you live, there’s a chance to score a better deal. You just need to know where to look. And that’s where your agent comes in.

Your agent can help you identify which homes have been on the market the longest. Those are the ones where you’re more likely to get a discount. That’s because the seller may be getting frustrated their house hasn’t sold yet, so they’re more willing to play ball.

And since a lot of buyers steer clear of homes that aren’t selling, you may be the only offer they get. So, you can lean in and push for a better deal. As Realtor.com explains:

“Less competition means fewer bidding wars and more power to negotiate the extras that add up: closing cost credits, home warranties, even repair concessions . . . these concessions can end up knocking thousands of dollars off the price of a home.”

And they’re not the only ones calling out the opportunity you have right now. Bankrate also says:

“During the quieter fall and winter months, when fewer prospective buyers are shopping, home sellers may be more willing to lower their prices, or offer concessions, to attract those prospective buyers who are still looking.”

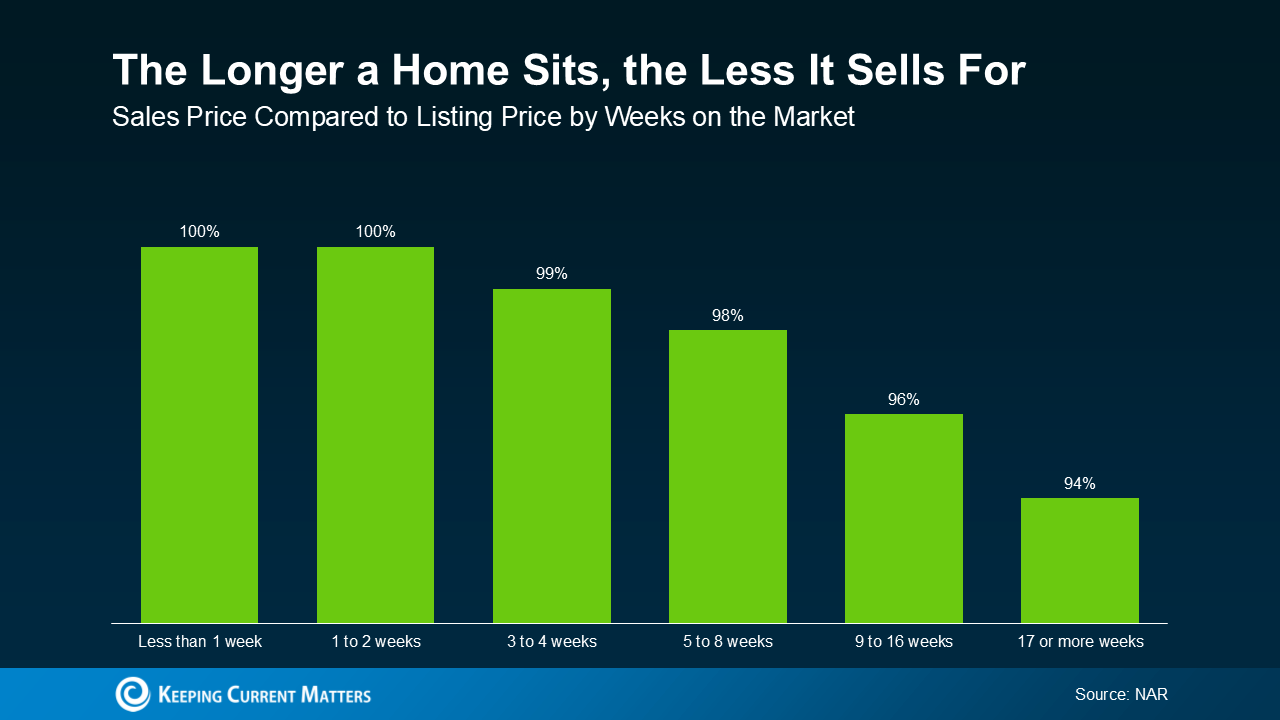

And the proof is in the data. The National Association of Realtors (NAR) shows a clear pattern: the longer a home stays on the market, the lower it tends to sell for compared to the original asking price.

So, if you’re serious about getting as much as you can for your money, focusing on these listings could be your best strategy yet.

So, if you’re serious about getting as much as you can for your money, focusing on these listings could be your best strategy yet.

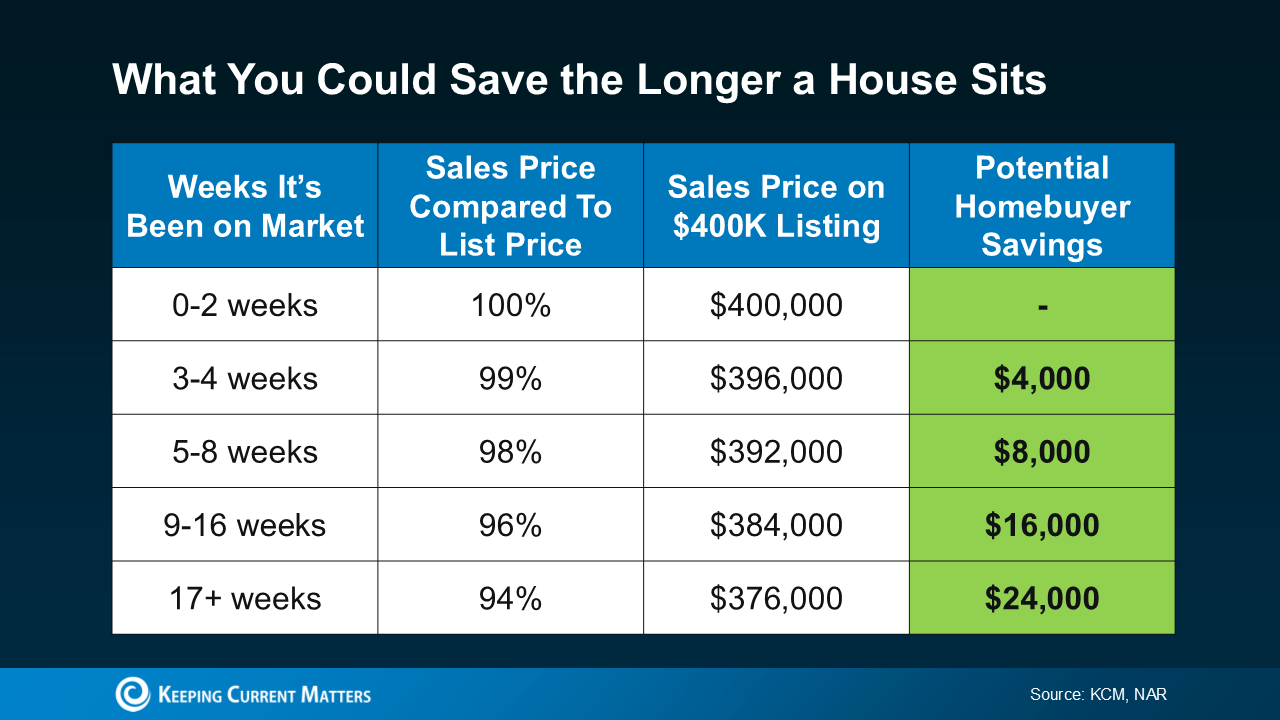

And while paying 94% of the original asking price may not sound like much of a deal, the savings add up. That’s roughly $24,000 in savings on the median priced home (see chart below):

Zillow sums it up best:

Zillow sums it up best:

“If you’re a buyer who is hoping to strike a deal, look for homes that have been on the market for a while and that may already have lowered prices to entice buyers. You may find a motivated seller who is more willing to negotiate.”

If you want to find the best deal possible on a home right now, start by looking where others aren’t.

With 1 in 5 sellers cutting prices and many growing more flexible by the week, the homes that have been sitting a little longer could be your best opportunity to save.

Talk to a local agent about where to find them in your area.

Source: Keeping Current Matters

Realty Executives Midwest

1310 Plainfield Rd. Ste 2 | Darien, IL 60561

Office: 630-969-8880

E-Mail: experts@realtyexecutives.com

Here’s something you should know before you sell your house. The homeowners who win in today’s market aren’t the ones waiting it out or stepping back. They’re the ones who adapt from the start.

A number of homeowners this year didn’t get the outcome they wanted. But it’s not because something’s wrong with the market. It’s because something wasn’t right with their expectations.

Realtor.com reports 57% more homes have been taken off the market compared to last year. That means they listed… but didn’t sell. But here’s the honest truth. It was mostly because of two things: price and timing.

And if the seller had come in with the right mindset on each, their sale would’ve gone differently. Here are the top 2 things you can learn from those other sellers.

Let’s start with the most common sticking point: the asking price. Today, 8 in 10 sellers expect to get their asking price or more. But that confidence doesn’t always line up with reality.

According to Redfin, only 1 in 4 (25.3%) sellers are actually getting more than their list price.

And here’s where the mismatch is coming from.

And here’s where the mismatch is coming from.

A few years ago, you could set any price and buyers would come running, no matter what the price tag said. Odds are, you’d still sell for over asking. But things are different now.

Buyers have more options than they’ve had in years, so they can afford to be more selective. If your price feels even a little high to them, it’ll get overlooked in a heartbeat.

And for the homeowners who had that happen, some end up pulling their listings instead of making a simple adjustment that could have changed everything. Which is a shame, honestly. Because a small price tweak is usually all it takes to bring buyers in and get the deal done.

According to HousingWire, the average price cut right now is just 4%.

Think about that. Other sellers are listing too high and giving up rather than dropping their price 4%. If they’d just started 4% lower, they may have already sold. So, before you list, talk to your agent about what’s working nearby. They’ll help you find the sweet spot that’s competitive, realistic, and still protecting your bottom line.

And here’s the kicker. If you’ve been in your home for a while, your equity gives you room to set your list price more competitively and still come out way ahead. Unfortunately, those other sellers didn’t seem to realize that.

Another common misstep: expecting your house to sell in a weekend.

Many sellers right now remember when homes sold in as little as hours – and they expect that to happen today. But in most markets, that’s not the reality anymore.

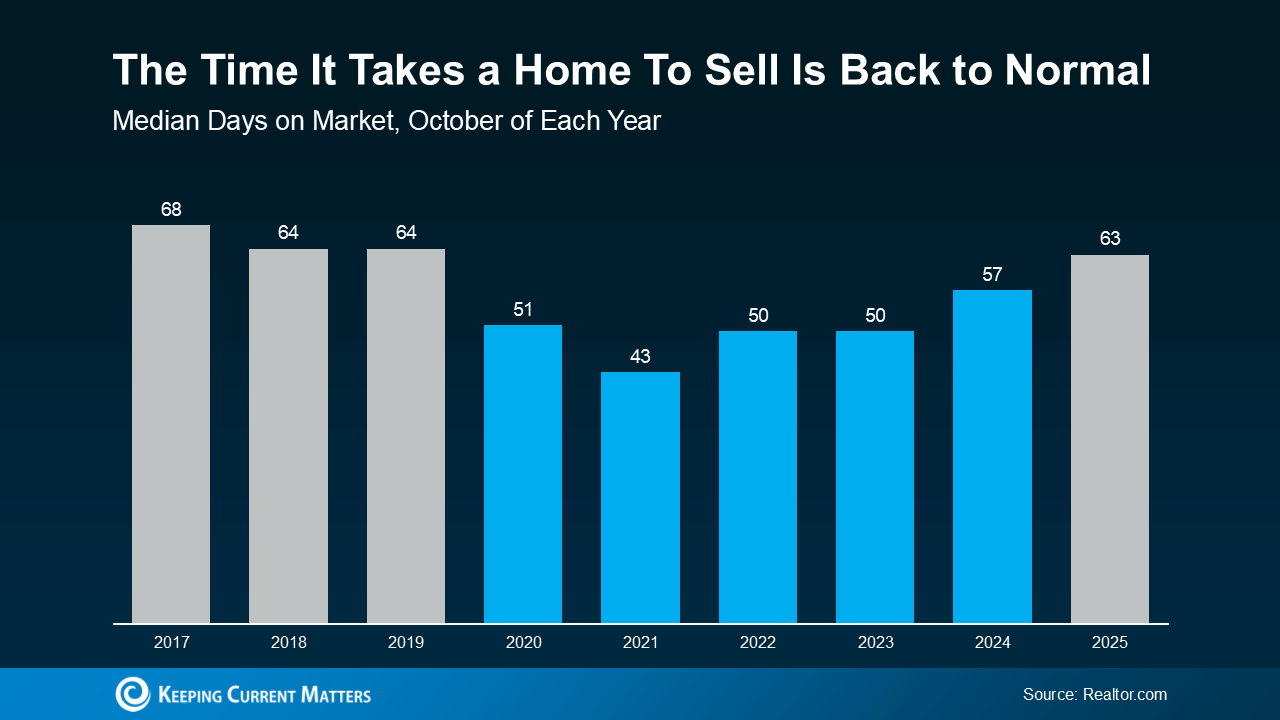

It takes closer to 60 days to go from listed to sold, which is actually normal (see the gray in the graph below):

It just feels slower because they’re comparing it to the lightning-fast pace of 2020 and 2021.

It just feels slower because they’re comparing it to the lightning-fast pace of 2020 and 2021.

Think of it like driving 65 mph on the highway, then exiting and going 25. It feels like you’re crawling, but it’s actually the right speed for where you are. That’s what other sellers can’t seem to get over. But you can get ahead of that, by knowing what to expect.

Today’s buyers are more intentional. They’re taking their time, weighing their options, and making thoughtful decisions, which is creating a much healthier housing market.

So, if you’re planning to sell, don’t expect it to happen instantly. And don’t assume your house won’t sell if it doesn’t go under contract in the first weekend.

It’s normal for these things to take time.

If you want to make sure your house sells as quickly as possible, talk to your agent about ways to stand out, whether that’s through staging, photography, or strategic pricing. With the right advice, the right price, and the right prep work, it can still sell quickly.

If you’re thinking about selling, don’t let the market discourage you, let it guide you. The listings that didn’t sell this year weren’t doomed. They just started with the wrong strategy.

You can still win if you price right, are patient, and work with a local agent who knows how to position your home from the start.

Because in today’s market, success isn’t about waiting for conditions to change. It’s about getting your expectations right from day one.

Source: Keeping Current Matters

Realty Executives Midwest

1310 Plainfield Rd. Ste 2 | Darien, IL 60561

Office: 630-969-8880

E-Mail: experts@realtyexecutives.com

If there was one simple step that could help make your home sale a seamless process, wouldn’t you want to know about it?

There’s a lot that happens from the time your house goes under contract to closing day. And a few things still have to go right for the deal to go through. But here’s what a lot of sellers may not know.

There’s one part of the process where some homeowners are hitting a road bump that’s causing buyers to back out these days. But don’t worry. The majority of these snags are completely avoidable, especially when you understand what’s causing them and how to be proactive.

That’s where a great agent (and a little prep) can make all the difference.

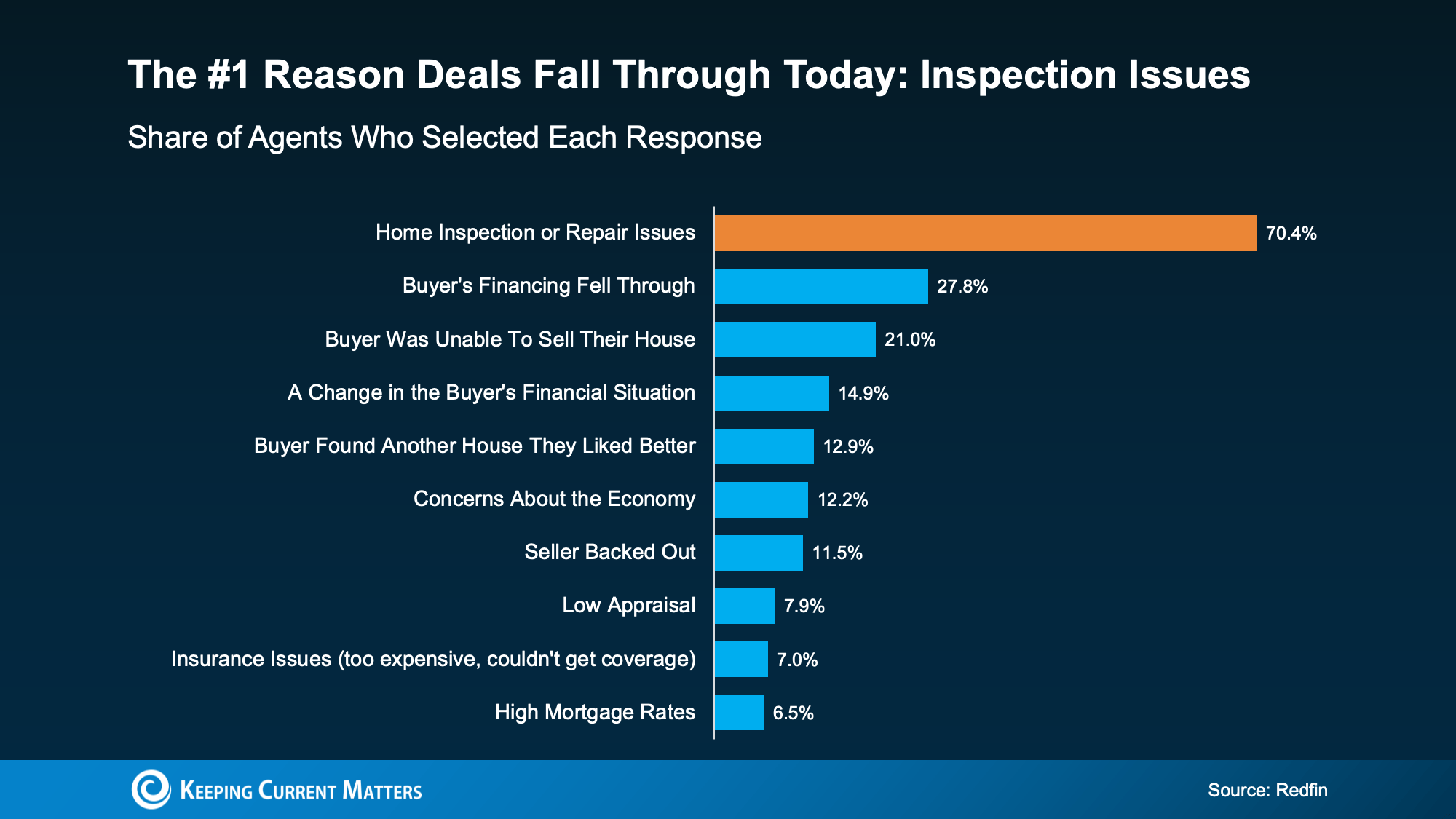

The latest data from Redfin says 15% of pending home sales are falling through. And that’s not wildly higher than the 12% norm from 2017-2019. But it is an increase.

That means roughly 1 in 7 deals today don’t make it to the closing table. But, at the same time, 6 out of 7 do. So, the majority of sellers never face this problem – and odds are, you won’t either. But you can help make it even less likely if you know how to get ahead.

You might assume the main reason buyers are backing out today is financing. But that’s actually not the case. The most common deal breaker today, by far, is inspection and repair issues (see graph below):

Here’s why that’s a sticking point for buyers right now:

Here’s why that’s a sticking point for buyers right now:

The sellers with the best agents have heard about this shift and they’re doing what they can to go in prepared. Enter the pre-listing inspection.

It’s exactly what it sounds like. It’s a professional home inspection you schedule before your home hits the market. And while it’s not required, the National Association of Realtors (NAR) explains why it could be a valuable step for some sellers right now:

“To keep deals from unraveling . . . it allows a seller the opportunity to address any repairs before the For Sale sign even goes up. It also can help avoid surprises like a costly plumbing problem, a failing roof or an outdated electrical panel that could cause financially stretched buyers to bolt before closing.”

Think of it as a way to avoid future headaches. You’ll know what issues could pop up during the buyer’s inspection – and you’ll have time to fix them or decide what to disclose before you put your house on the market.

This way, when the buyer’s inspector walks in, you’re ready. No surprises. No last-minute panic. No deal on the line.

Generally speaking, a pre-listing inspection costs just a few hundred dollars. So, it’s not a big expense. And the information it gives you is invaluable. But before you make that investment, talk to your local agent.

In some markets, it may not be worth it. And in others, it may be the best move you can make. It all depends on what’s happening where you are and what’s working for other local sellers. If your agent recommends getting one, they’ll also:

That small step could save your deal (and your timeline).

So, if there was one simple step that could help make your home sale go according to plan, would you do it?

If you’d rather deal with surprises on your terms (not with the clock ticking under contract), talk to an agent about whether a pre-listing inspection makes sense for your house.

It may be worth it so you can hit the market confident, prepared, and in control.

Source: Keeping Current Matters

Realty Executives Midwest

1310 Plainfield Rd. Ste 2 | Darien, IL 60561

Office: 630-969-8880

E-Mail: experts@realtyexecutives.com

There’s been a lot of talk lately about how a government shutdown impacts the housing market. You might be wondering: Is it causing everything to grind to a halt?

The short answer? No.

The housing market doesn’t stop. It keeps moving. Homes are still being bought and sold, contracts are still being signed, and closings are still happening. The difference is that a few parts of the process may slow down a little, but overall, the market continues to function.

Whenever the government shuts down, some federal agencies temporarily close or scale back their operations. That can cause a few hiccups in real estate, especially when it comes to processing certain types of government loans and insurance requirements:

Even with those challenges and delays, most transactions still go through. Buyers keep buying, sellers keep selling, and agents keep helping people move forward.

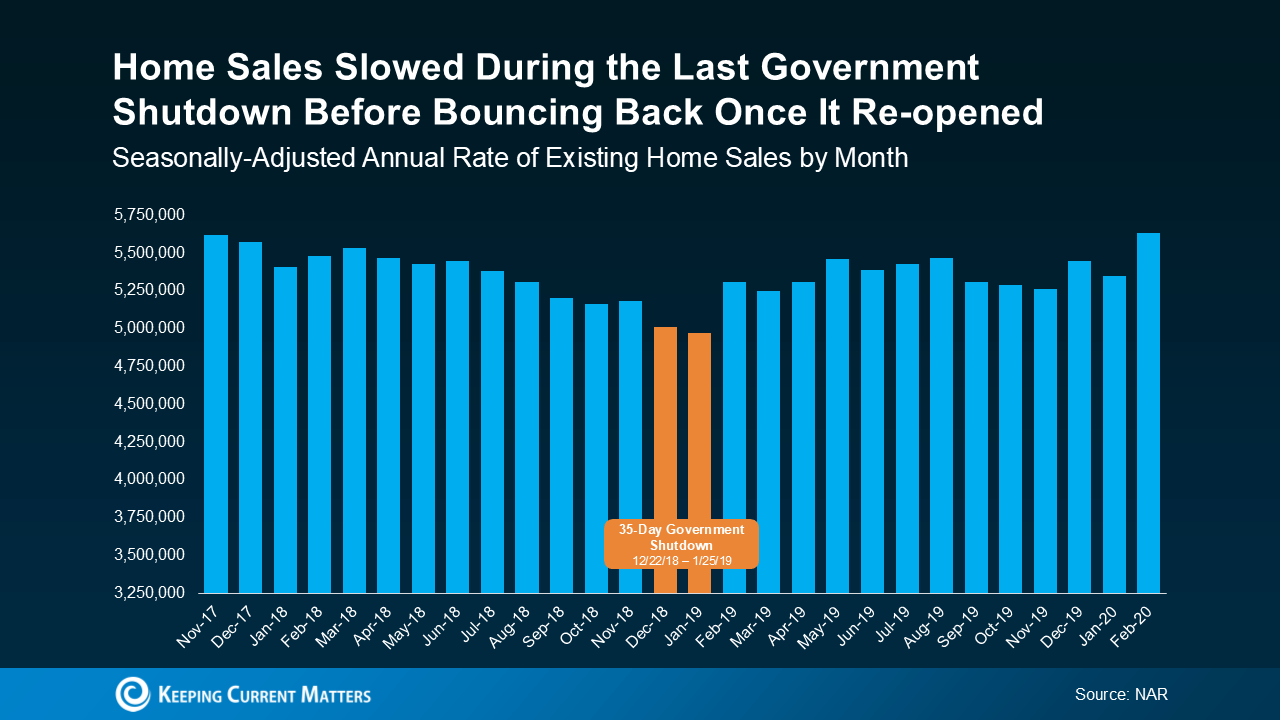

And you can see that play out in this data. If you look back at the most recent government shutdown that began at the end of 2018 and lasted for 35 days, sales activity dipped very slightly during the closure but picked right back up once the government reopened.

Data from the National Association of Realtors (NAR) shows existing home sales slowed for about two months, and then rebounded quickly as delayed closings worked their way through the system when the government reopened (see graph below):

What’s important to note is that the slowdown you see in the orange bars on this graph wasn’t simply due to seasonality in a typical housing market cycle. The sharper, shorter drop in this case lines up exactly with the 35-day government shutdown, and then sales bounced back as soon as it ended.

What’s important to note is that the slowdown you see in the orange bars on this graph wasn’t simply due to seasonality in a typical housing market cycle. The sharper, shorter drop in this case lines up exactly with the 35-day government shutdown, and then sales bounced back as soon as it ended.

If you’re in the middle of buying or selling a home, don’t panic. Most deals will still move forward, even if it takes a few extra days. Jeff Ostrowski, Housing Market Analyst at Bankrate, explains:

“If you’re expecting to close in a week or a month, there could be some slight delay, but I think for most people, it’s probably going to be a blip more than a real deal killer.”

And if you’re just starting to think about buying or selling, this could actually work in your favor. Some buyers and sellers may become cautious and pause their plans during times of uncertainty, like this, and that can open a short window of opportunity.

When fewer people are active in the market, well-prepared buyers may find less competition for homes, and motivated sellers may be more willing to negotiate. These brief slowdowns often create a moment where you can make a move that would be harder once activity ramps back up.

A government shutdown can cause short-term delays for some buyers, but it doesn’t derail the housing market. The last time this happened, sales picked back up as soon as the government re-opened.

If you’re unsure how this might affect your plans, or just want to make sense of what’s happening, connect with a local real estate agent.

Source: Keeping Current Matters

Realty Executives Midwest

1310 Plainfield Rd. Ste 2 | Darien, IL 60561

Office: 630-969-8880

E-Mail: experts@realtyexecutives.com