Cindy Curd

Real Estate Broker

Realty Executives of Kansas City

Judging by the rumblings I am hearing, the biennial notices from the Jackson County Assessment Department are hitting mailboxes. If you are a property owner in Jackson County, MO, you should receive one of these notices in odd numbered years.

No matter what the assessment notice says, the recipient is generally shocked by the market value that has been assigned to their home. Most of the calls I have been receiving are from people who think the market value of their home is estimated by the county to be too high.

The market value of homes is used to calculate an assessed value, which is then used to calculate the amount of property taxes that will be owed at the end of the year. The assessed value is multiplied by the mill levy of the taxing district in which the property resides. Those tax dollars are used to fund a myriad of local services, most notably (usually more than half), the local school district.

If you are shocked by the market value you are seeing for 2019, you are not alone! These increased values are a byproduct of the increased sales prices we have enjoyed the past two years. While we all like to know that our investment is gaining value by virtue of the sales market, it is a hard pill to swallow when it hits our pocketbooks in the form of higher taxes.

1) Go to an online service like Zillow. What does it give as your "Zestimate"? Is it close to the Market Value assigned by the county? If so, look at a couple of your neighbor's homes. Are their values similar to yours? Are their homes similar to yours? If so, the county probably got it pretty close or they have messed up your whole block or neighborhood. This might be enough to satisfy you and you can know that at least your property value is going up...not down. Save some extra cash, You are going to need it at the end of the year when the tax bill comes due.

2) Call a local Realtor. OK...call me! I would be happy to consider the increase of your property and can usually let you know pretty quickly if it is reasonable or not.

After taking these steps, if you still believe that your 2019 Market Value is too high, you can appeal your value with the county by asking for an informal review before June 24. You can start the process by going to www.jacksongov.org/review. There is an online form to complete. You will need the parcel number and PIN that is on your Reassessment Notice. Once you have completed the form, download or print the form and either email, mail or fax it to the assessment department. You will need to provide written support for reducing your market value. That support could be nearby home sales or a recent appraisal on your property. A Realtor can also provide you will some sales comps that could help your argument.

I am always available for your questions. Please call, email or text me or submit them to me here: http://www.realtyexecutives.com/Agent/Cindy-Curd/Services

Spring is right around the corner and this is the time that many people begin to think about purchasing a home. In our region, spring and summer are the most common times to buy or sell a home. I have put together a list of tasks, roughly in order, that you will need to complete in order to move into the home of your dreams.

Home Buying Process

Finally, you are ready for to close! Go to the title company with a cashier's check for the required amount and sign a bunch of papers. In most cases, you will receive possession of you home when all of your loan funds are available to be distributed.

There are a lot of steps. I would be happy to help you navigate them and would be greatful for any buyers you send to me to help. You can reach me at www.cindycurdrealestate.com or 816-665-8281 or cindycurd@realtyexecutives.com

Is an HOA Worth the Hassle?

There has been a lot of press lately about Home Owner's Associations and by far, the press has been negative. Just a few examples from our Kansas City Star:

Olathe Man's War with HOA over Landscaping

Angry Residents Dig for Truth...

A common thread from these articles is that they are all written by the same person. Draw your own conclusions from that...I am not going there.

Where I am going is that home owners and buyers need to be aware of HOA rules, procedures and practices before committing to abide by them, which you do when you purchase a home in an area with a Home Owners Association.

If you are attracted to a housing area because of conforming architecture, a pleasing color palette, and streets that are unclogged by vehicles, you can bet there is a governing body that is ensuring that those qualities continue. If you are not willing to participate in keeping those standards where they are, then this place might not be the right place for you.

HOAs are not interested in your freedom to choose or even what you may define as your "needs". They are interested in preserving the atmosphere that they currently offer to all the other residents that have chosen this sanctuary as a place to live.

As a Realtor, my clients often direct me that they want to live in an area without an HOA. I appreciate that they narrow the scope significantly for me from the get-go, but I always ask a the follow-up questions, "Why? What is it about HOAs that you object to? What things in your lifestyle do you think will cause conflict with an HOA?" Now, I am not one to push anyone into a neighborhood where they do not want to be, but I think there is a lot of misunderstanding out there about the pros and cons of Home Owners Associations.

Rule #1: Know the rules before you buy. Ask your Realtor for a copy of the HOA Covenants. They are often available online or can be obtained directly from the Association. TRUST ME: They want you to know the rules before you move in.

Asking for the covenants is not enough. You have to READ them. If you find something in the HOA rules that you cannot live with, DON'T MAKE AN OFFER ON THE HOME.

Some rules are vague and say something along the lines of "landscape changes must be approved by the architectural committee prior to installation". Do not take that to mean that if you ask for permission, it will be granted. Do you see other 12x12 four foot raised beds full of tomatoes in any other front yards? You are not likely to get approval for that either.

Rule #2: Do a thorough home inspection. If your HOA is responsible for some of the maintenance on your home, hire a professional to make sure it has been done correctly.

Rule #3: Do not expect the HOA to change for you. They won't. It's not worth the battle. Even if you get on the board and try to make changes, a vote of the entire association is still necessary to make the change. Didn't you learn this basic principle when you were looking for a spouse? Same applies.

Rule #4: Be ready to move again if you have to. If your living situation changes, you may actually have to relocate. If you move in to an age-restricted community that allows only one person under the age of 55 to live in dwelling and you end up adopting 3 grandchildren, you are going to have to find another place to live. Hopefully, your super-strict HOA has kept the living standards up and you will be able to sell quickly to someone who was once just like you.

Sometimes it is not just about the rules. Sometimes it is the management of the HOA that is problematic. Ask to see financial statements. All HOAs have them. Then, as one final check, if you are really concerned about renegade and oppressive HOAs, check your county court filings. If you find your HOA involved repeatedly as either Plaintiff or Defendant, there might be a problem. Use discretion because one cranky resident who does not want to follow the rules can produce a boatload of lawsuits. This could cause the Association to have some hefty legal bills, but doesn’t necessarily mean that they are a problem for all residents.

Most importantly, take responsibility for yourself. Do not put yourself in a situation that is ripe for conflict. You know what kind of person you are. Don't give yourself more than you can handle.

I love to talk about real estate and welcome the opportunity to help people find their dream home. Please contact me to learn more.

For this house, YES...but seriously....

Congratulations! You have signed a contract to purchase a home! It will be your refuge, your solace, your place to return to time and again. It will be the place you entertain, laugh, cry, cook, play and sleep. It will keep you warm in the winter, cool in the summer and dry when it rains...or will it?

There are no guarantees of any of those things, but there is something you should do to give you a better understanding of the mechanical and structural viability of what is probably your largest financial investment: Hire a qualified home inspector!

A home inspector will take a close look at your property and give you an opinion as to which items in the home are in good shape and which ones need attention or repair. A good inspector will have an eye for safety concerns and potential structural problems that could be hiding in your home and costly to repair.

It is a good idea to choose an inspector who has been certified by a professional organization. Those certifications require that inspectors stay up to date on evolving issues in the industry through continuing education. There are many, but the two largest are ASHI and InterNACHI.

A good Realtor should be able to refer a few inspectors to you. Also, friends and family that have moved recently can share their experiences with you. Talk to a few inspectors before you hire one. Questions to ask:

Good home inspectors stay busy, so start your search as soon as you sign your contract. It is important to remember that ALL homes have imperfections. A home inspection is a tool for identifying if there are costly issues that may make the home purchase impractical for you. Sellers are usually willing to assist by repairing some defects that are identified through home inspection, so don't be afraid to ask for reasonable repairs to be done as a condition to closing on the property.

For more information about home inspections or real estate, please click HERE and I will get an answer for you right away!

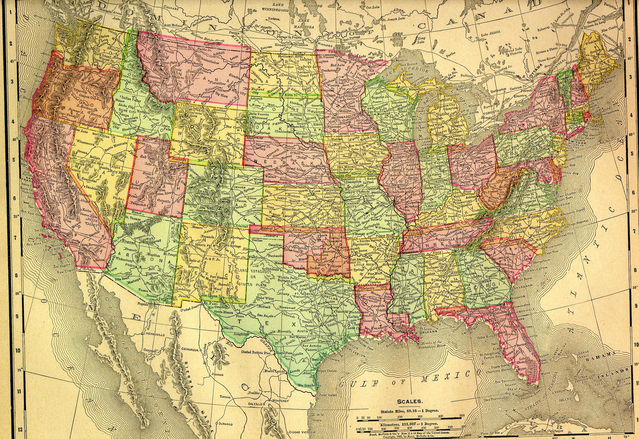

Moving across town can be hectic and confusing enough, but what if you are relocating ACROSS THE COUNTRY?

And there is! First of all, begin your search on a site that will not sell your information to anyone else. Try this site: Find a home ANYWHERE

It utilizes ListHub data to bring you information from more that 63 different MLS (Multiple Listing Service) areas all in one place. Secondly, contact a trusted local Realtor. Call someone you have used before or one who has been referred to you by a friend. That Realtor can interview and recommend a Realtor for you to use in the new location...and they should not charge you for that service!

If you find that you cannot locate homes through ListHub data at the site above and just want to talk to someone who can get you in touch with a reputable Realtor in the city to which you are relocating, please CLICK HERE and someone will get in touch with you right away with the promise that your info will not be sold!