(Published on - 8/3/2021 6:03:19 AM)

Can this SELLER'S MARKET be sustainable?

We have been in a Seller's Market since 2015. But see how today's market is totally different from previous housing cycles. This 3 minute video uses comparative statistics to demonstrate the housing appreciation this time is real. It will eventually slow to a more reasonable pace of appreciation, but there is no indication it will fall.

2021: HIGH Rental Rates, High Demand, Lack of Inventory.

Back in 2005, Investors drove up housing prices thanks to EASY access to money. Today's demand is driven by owner-occupant homebuyers. Secondly, back in 2005, while home prices skyrocketed, Rental Rates BARELY moved. Today's rental rates have SKYROCKETED, even despite the low interest rates.

2008: Flat Rental Rates, FLAT Demand, Surplus of Inventory.

Back in 2008 the housing market had become saturated with single family home rentals.  With no rental demand, vacancies soared. And without income to service the debt, thousands of investors foreclosed. Home values plummeted. Construction stopped. The building trades suffered, and many went out of business. Builders became timid. Fast forward and we see how housing construction did not keep pace with organic population growth in the ensuing years following the crash. This is a large contributor to our housing shortage today. Housing Market Statistics can be seen graphically HERE

With no rental demand, vacancies soared. And without income to service the debt, thousands of investors foreclosed. Home values plummeted. Construction stopped. The building trades suffered, and many went out of business. Builders became timid. Fast forward and we see how housing construction did not keep pace with organic population growth in the ensuing years following the crash. This is a large contributor to our housing shortage today. Housing Market Statistics can be seen graphically HERE

Here's why the US May Have a Housing Boom for the Next 5 Years

According to ADVISOR PERSPECTIVES August 2, 2021, "The United States is just at the beginning of a housing boom that could last for the next five years. In contrast to the early naught housing boom that was at least in part driven by shoddy lending standards, this one appears to be squarely driven by an utter lack of housing inventory." The article focuses on the construction slow down that followed the crash of 2008.

"Following the housing bust in the 2007-2009 period, and the excess inventory it created, homebuilders responded by slashing construction of new homes. New home construction fell from an average of 2M units per year in 2006 (too many units) to an average of less than 1M units per year (too few units) for the entire 2009-2020 period. This occurred at a time when the working age population (the group most likely to buy new houses) in the US increased by 9M people and the total population increased by 25M people. The lack of construction for the last decade, and especially over the last five years when a lack of inventory has become a major issue, appears to be a significant, if not the primary driver of house price appreciation." Full Article HERE

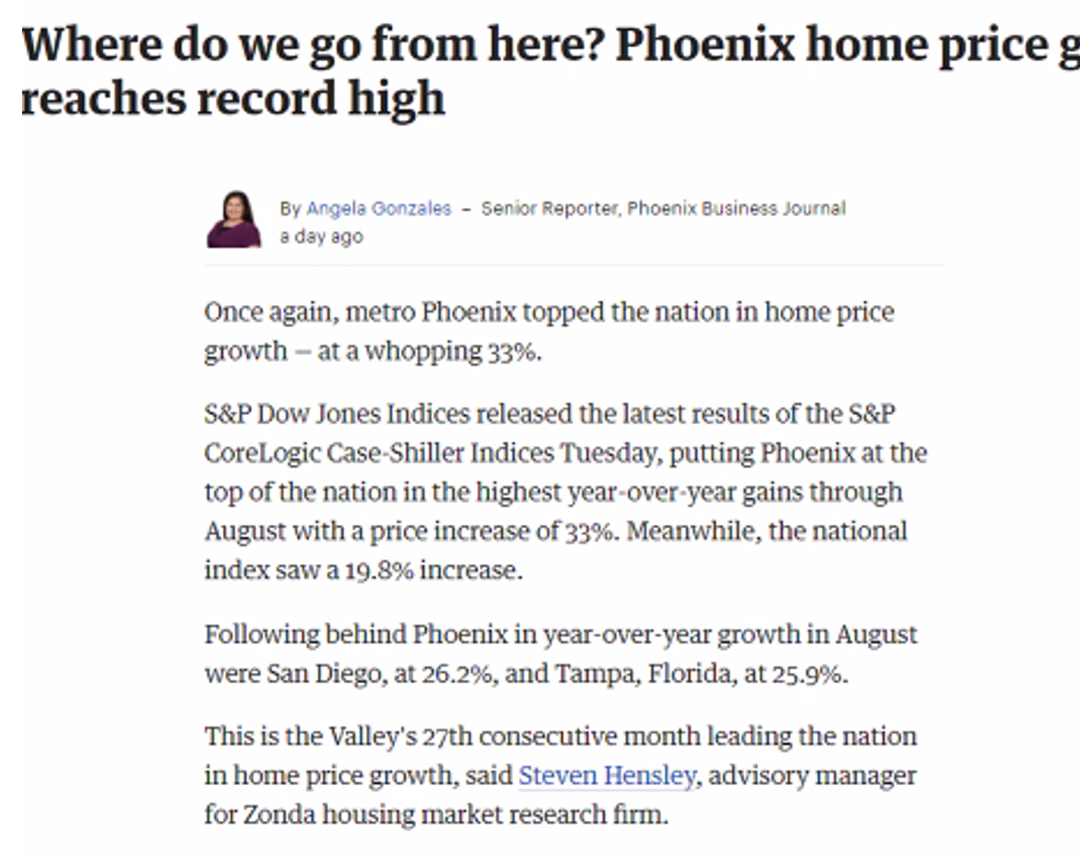

Phoenix leads Nation in Price Growth

followed by San Diego & Seattle

According to the Phoenix Business Journal 7/28/2021: "Despite a bit of softening in housing demand and a small uptick in the housing supply, home price growth in metro Phoenix continues to top the nation, according to the S&P CoreLogic Case-Shiller U.S. National Home Price NSA Index.

Phoenix led the nation with a 25.9% year-over-year price gain in May, followed by San Diego at 24.7% and Seattle at 23.4% at a time when the national gain of 16.6% set a record high.

While homebuilders and developers have been busy buying land throughout the Valley, the housing supply is still very constrained, said Thomas Brophy, research director for Colliers International.

As of the end of June, the Arizona Regional Multiple Listing Service pegged current for-sale inventory at 1.05 months — maintaining below a 2 month supply since May 2020, Brophy said.

"Anything below three months indicates the market is experiencing inventory shortages," he said. "Shortages, most likely will continue through the remainder of the year and into early next year as homebuilders continue to ramp up production."

LUXURY HOME MARKET REPORT

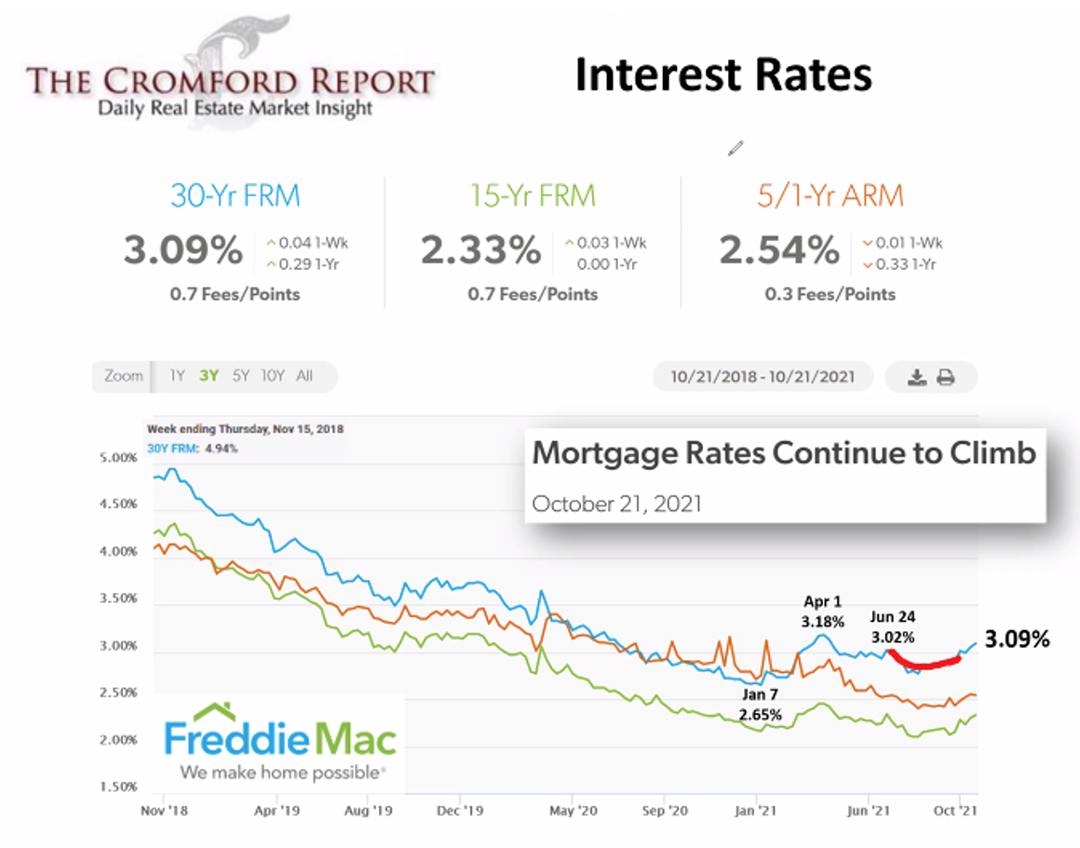

The August Luxury Home Marketing institute report provides a 6 month recap of luxury home statistics throughout North America. Download full report, including local reports for Scottsdale and Paradise Valley HERE. "Record low interest rates, increased household savings, strengthening stock market, and a continued focus on living space during the pandemic were all factors that helped bolster demand," stated Diane Hartley, CEO of The Institute for Luxury Home Marketing. "Now the steady, and in some markets "heady," price growth has started to encourage more sellers to list their homes."

Denise van den Bossche has been a licensed agent in the Phoenix-Scottsdale Valley since 1985. Her husband of over 20 years, Patrick, is President of Realty Executives International supporting over 550 offices worldwide. Is this a good time to buy or sell? Contact at denise@denisevdb.com

Contract Ratio: A Clear Predictor of When Home Values Will Fall. December 2021

Contract Ratio: A Clear Predictor of When Home Values Will Fall. December 2021

Click

Click  Last May, the National Association of Realtors (NAR) created a Clear Cooperation policy to address the growing use of off-MLS listings. The NAR concluded that leaving listings outside of the broader marketplace excludes consumers, undermining REALTORS®' commitment to providing equal opportunity to all. The policy states:

Last May, the National Association of Realtors (NAR) created a Clear Cooperation policy to address the growing use of off-MLS listings. The NAR concluded that leaving listings outside of the broader marketplace excludes consumers, undermining REALTORS®' commitment to providing equal opportunity to all. The policy states: The below chart shows Supply and Demand in the current housing market. In the months leading up to the crash of 2008, we saw a drastic increase in housing supply (red), and a sharp decline in demand (green) as investors were offered easy money with little-to-no skin in the game. We would need a similar surge in supply to reduce the demand in order to see a drop in housing prices today. And we would be able to see this happen statistically over a period of several months.

The below chart shows Supply and Demand in the current housing market. In the months leading up to the crash of 2008, we saw a drastic increase in housing supply (red), and a sharp decline in demand (green) as investors were offered easy money with little-to-no skin in the game. We would need a similar surge in supply to reduce the demand in order to see a drop in housing prices today. And we would be able to see this happen statistically over a period of several months.

With no rental demand, vacancies soared. And without income to service the debt, thousands of investors foreclosed. Home values plummeted. Construction stopped. The building trades suffered, and many went out of business. Builders became timid. Fast forward and we see how housing construction did not keep pace with organic population growth in the ensuing years following the crash. This is a large contributor to our housing shortage today. Housing Market Statistics can be seen graphically

With no rental demand, vacancies soared. And without income to service the debt, thousands of investors foreclosed. Home values plummeted. Construction stopped. The building trades suffered, and many went out of business. Builders became timid. Fast forward and we see how housing construction did not keep pace with organic population growth in the ensuing years following the crash. This is a large contributor to our housing shortage today. Housing Market Statistics can be seen graphically