Realty Executives of Northern Arizona

Did you know that major customer review sites get hundreds of millions of views each month?

It’s hardly surprising when you think about it.

After all, when most people are looking to buy something, or hire someone, they tend to trust a recommendation more than an advertisement. That’s true whether you’re shopping for a car, restaurant, dentist, or… real estate agent.

In fact, referrals from valued clients are one of the main ways we build our business.

They are something we take very seriously. We work hard to be “referral worthy” by providing excellent service and continuing support — not just during a client’s move, but in the years afterward. This e-newsletter is just one of the many ways we do that.

So, the next time you come across a neighbor or friend looking for a good real estate agent, we hope you’ll feel comfortable giving them our names.

We’d really appreciate it!

And, please allow us to return the favor. The next time you’re looking for a real estate-related professional — such as a contractor or electrician — reach out to us for a referral from our network. We’re happy to help.

Flagstaff Real Estate Market Update through April 2023

A quick recap of the Flagstaff market comparing Jan 2022 - April 2022 vs Jan 2023 - April 2023. This includes all residential (condos, townhomes, manufactured homes & single family homes) property located in Flagstaff: Our median sales price through April 2023 is sitting at $599,999 and last year at this time it was $650,000. Closed sales are down 39.1%, WOW! Median days on market has increased from 40 in 2022 to 53 or 35.9%. List price received is still high at 98.0% but new listings are down 16.1%. These numbers confirm that our inventory is still quite low but things have certainly shifted. If you have any questions about the market please feel free to reach out!

Hope you have a wonderful Memorial Day Weekend!

|

Renee Gaun 928-606-6232 Renee |

15 E. Cherry Ave |

Once you find the perfect home, we will help you to write your offer on an Arizona Residential Purchase Contract. The purchase contract is only 10 pages long but there will most likely be a handful of other forms that will need to be signed. Signing can be done in person or electronically. We will help you gather information so that you can make an educated decision about how much to offer and what to request of the sellers. It may seem like a lot and every house is different, but we have done this so many times and will walk you through the process so that you will have no regrets about what you offer - whether you get accepted or not.

One of the decisions you will need to make is how much Earnest Money to offer. This is a small amount of money that the Escrow department will hold on to once your offer is accepted and throughout the transaction. Think of it as a “deposit” to hold the house. When you close on the sale, this money will be applied to the amount of funds you needed to bring to the closing. If you cancel the transaction, your earnest money may be forfeited to the seller if you cancel the contract the wrong way. We always watch out for this and will make sure you know when the right times and reasons to cancel are.

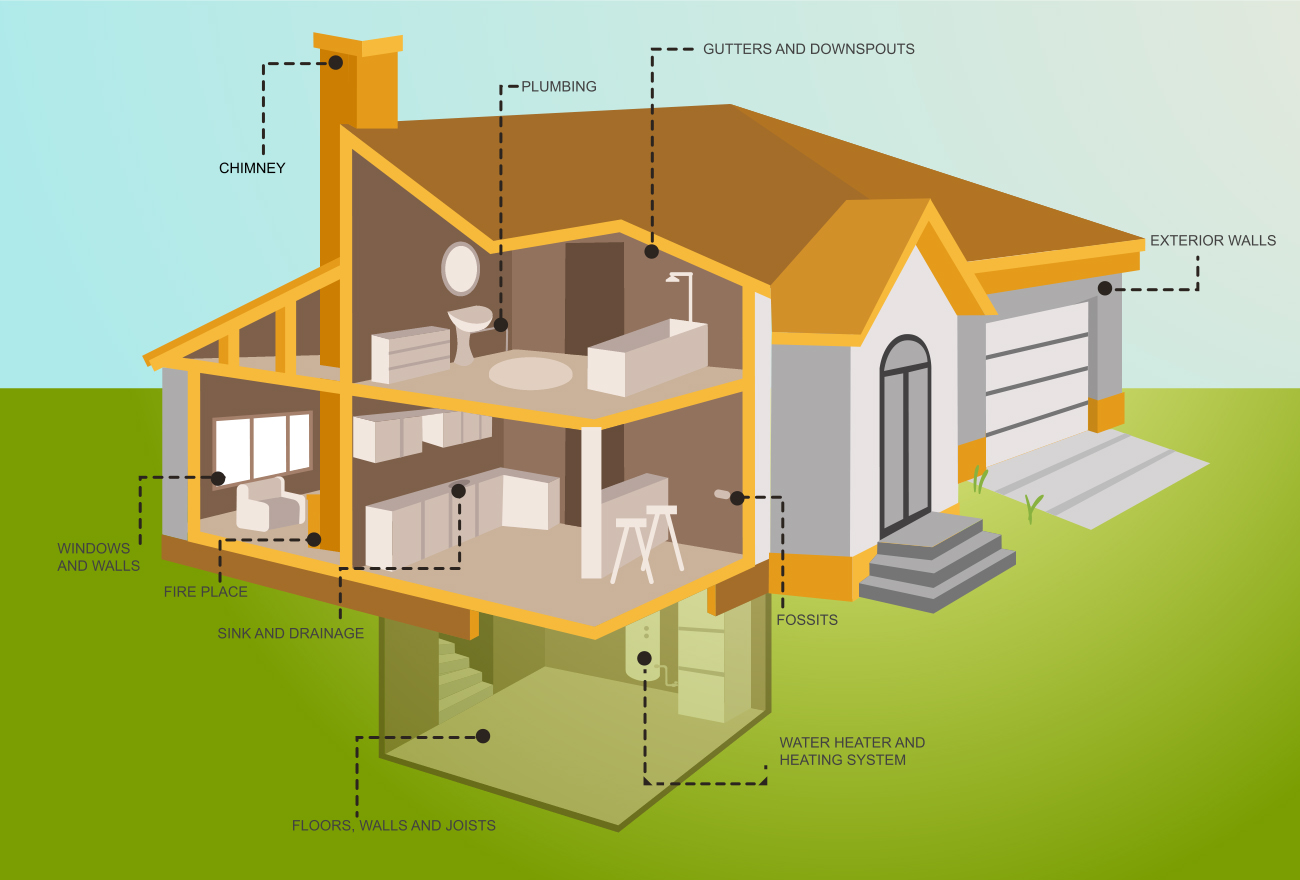

Once you are under contract, you immediately begin the inspection period. This can be any number of days and are stipulated in the contract. It defaults to 10 days. During this time, you will have the opportunity to hire various inspectors to review the home and provide you with a report about their findings. A home inspector checks the overall home but may suggest a specialist to double-check portions of the home. These specialists may include a roof inspector, termite/pest inspector, Radon inspection, plumber, sewer inspector or septic inspection… really, any inspector that may find flaws that could adversely affect the value of the home. Keep in mind, verification of the square footage must also be established during the inspection period if it is of importance to you. By the end of the inspections, you will know a lot about the home. You will need to decide if you are still interested in buying the property. If not, you can cancel the contract by letting the seller know what it was about the home that caused you to cancel. If you are ready to continue with the sale, you can still ask the seller to repair all or some, of the items that were discovered, in the next step.

The Buyer's Inspection Notice and Seller's Response (BINSR) is the form that is used by the buyer to either cancel the contract or proceed after the inspections are complete. If you choose to proceed, you can use the form to request that specific repairs be performed by the seller before the sale closes. Once delivered to the sellers, they then have 5 days to respond with acceptance to do the repairs, a rejection of the repairs or a counteroffer of how and which repairs will be done. There is also a possibility that the sellers will offer a reduction of the sales price or a credit on closing day to offset their not performing some or all of the repairs. Once the sellers return their response, you as the buyer then have 5 more days to decide if you accept their response or wish to cancel the contract. If you cancel during the BINSR process, you are most likely to have your earnest money returned to you. If you cancel after this point, there is a chance you may have to forfeit the earnest money.

If you are getting a loan to purchase the home, the lender will want an appraisal of the home to make sure they are not lending more than the home is worth. An Appraiser will compare your home to similar, recently sold homes in the area. Their training allows them to make very specific comparisons to those homes and then add or subtract value based on the differences. In the end, they will provide their assessment to the lender. If the appraised value is equal to or greater than the sales price, the sale can continue as planned. If the appraised value is lower than the sales price, you will again have the opportunity to cancel the transaction and receive your earnest money. You could also renegotiate the sales price with the sellers or, if they won’t budge, pay the difference between the sales price and appraised value to make sure the loan is not greater than the appraised value.

If the appraisal process goes well, you are through the last, major hurdle. At this point, you should start planning your move and getting the utilities set up to begin on the closing date in your name. These usually include water, electric, natural gas, trash and recycle for homes in town. If you are outside of town or in a rural neighborhood, you may alternatively need to consider propane and a water hauling service. Don’t forget to choose an Internet Service Provider and phone service if you use a landline. This might also be a good time to plan to turn off these services at your current home or rental.

The last 3 days before closing is your walkthrough period. During this time, the sellers should be moved out and if not, should try to accommodate you in coming over to review the property. If they agreed to repairs on the BINSR, are they done? In the process of moving, did the movers punch any holes in doors? Was there a huge hole in the wall behind the seller’s giant hutch that you couldn’t see when you first viewed the home? All of these items must be corrected. You will be presented with a Walkthrough form. On it, you will have the option to say the home is in about the same condition as when you first viewed it and that the sale can continue. If this is not the case, you will also have the option to list items that are not the same as when you viewed it or are repairs they agreed to perform that are not yet completed. This is called a “cure notice” and they then have 3 days to correct it or they risk your cancellation of the sale. The buyer has the ability to request another appointment to ensure the list of problems has been corrected. Keep in mind, the Walkthrough is not the same as the BINSR. If the doorknob jiggled during inspections, it is not something you would add to this list.

Closing Day is exciting! 5-7 weeks have likely passed since you first viewed your new home and today, if everything goes well, you will be handed the keys. If you haven’t already signed the Escrow and Lending documents, you will have to do it on closing day. Once both sellers and buyers have signed, everyone holds their breath waiting for the lender to fund the purchase. Once this happens, the documents are recorded with the county public records and the sale is complete. Don’t plan to show up at the house with the moving truck at 8 am. Recording may not happen in the morning and can happen as late as 2:30 pm.

Moving can be a very stressful time. You have been through so much at this point and unpacking boxes, discovering broken dishware, not having any idea what dinner will be are not the best way to start your adventure in your new home. We have worked with and vetted several resources and vendors so please don’t hesitate to ask us for referrals to these sanity-saving services. Be patient. Plan ahead and don’t forget that moving can be tough on kids and pets too. Don’t try to cook on the first night… you’ll never find your favorite pan anyway. Order a pizza and keep things easy. Pack items you know you’ll need right away (like toothbrushes, a couple of changes of clothing and medicine) in your travel luggage so that they are easy to find This should be a celebratory day and you should resign to the fact that you won’t be moved in for a while. Remember, one room at a time. It will look and feel like home before you know it.

Once you have settled in, your job as a homeowner starts. Only when you’ve lived in a home day to day do some of the subtle defects become apparent. Don’t be like the last owner and leave those items to be discovered when you sell your home down the road. Routine maintenance and updates will go a long way in increasing your home’s value. Don’t put this off until you list the home to sell – for two reasons: you will probably not recover the actual price you put into the projects and, if you wait until you list your home, you will not have derived the pleasure of the updates. Your roof, furnace and water heater are three of the most frequently called out defects in home inspections so try to keep these in top shape. Chipped paint, dry rot in the woodwork (especially on the exterior), pests, leaks and the damage they cause can really spook a buyer so have these items addressed. Finally, keep documentation of all of the improvements and updates that you’ve made. New roof, appliances, repairs of leaks… all of this documentation can calm a nervous buyer who may otherwise reduce their offer price in expectation of big repairs. Your new home is an investment and your role as a homeowner (or landlord) will help determine the return you will receive when it comes time to sell. Be sure to contact us early when you are ready to sell so that we can help you spot the items that might hurt the sale. We will be excited to work with you again!

Egle & Tyler

Egle Rucci

REALTOR®, ABR, GRI, CRPM

Realty Executives of Flagstaff

C (928) 600-5629 | Off (928) 773-9300

egle@propertiesinflagstaff.com | www.myflaghome.com

Connect with me: Facebook | Twitter | LinkedIn

The best compliment I could get, is a referral from you, your family and friends!

S Tyler Hood

Realty Executives of Flagstaff

15 E. Cherry Ave, Flagstaff, AZ 86001

tyler@propertiesinflagstaff.com

Call or Text: 928-440-0747

Office: 928-773-9300

~Kessler, Abigail. "Flagstaff broker predicts continued plateau in local housing market for 2024." AZ Daily Sun, Jan. 11, 2024, p. 1.

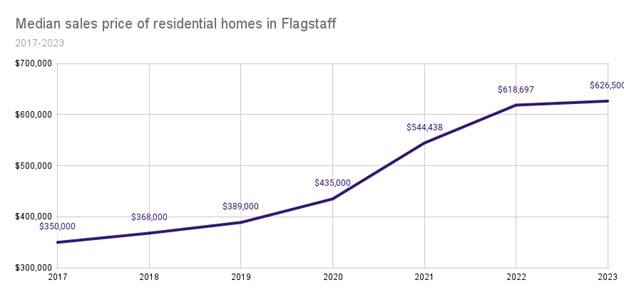

The rise in Flagstaff home prices slowed in 2023, according to data from the Northern Arizona Association of Realtors (NAAR).

NAAR’s market review for December 2023 shows the median sales price for a residential home in Flagstaff increased 1.3% in 2023 -- to $626,500 from $618,697 in 2022.

Gary Nelson, an associate broker with Realty Executives of Flagstaff, predicted that 2024 would continue the “plateau” seen in the housing market throughout 2023.

He expects this spring to resume the influx of listings and buyers typical for that time of year.

The above-average snowfall last winter had delayed that influx by a couple of months, he said, as sellers waited for the snow to melt before placing their homes on the market.

“Our home prices aren’t really dropping,” Nelson said. “They’re dropping in some neighborhoods and some price ranges, but it's more sporadic than it is an actual trend, in my opinion. We will continue to see that, I think, through 2024 -- the market plateaued in 2023, and we’re going to see that.”

The 1.3% increase in median sale price is smaller than in previous years. Home prices have risen throughout the 2020s so far, with the median sales price for Flagstaff residential homes increasing 11.8% in 2020, 25.2% in 2021 and 13.6% in 2022.

Graph showing the median sales price of residential homes in Flagstaff each year from 2017 to 2023, using data from NAAR's market review.

The market review for five years prior lists that Flagstaff’s median sales price was

$368,000 at the end of 2018 (and was itself 5.1% higher than 2017’s median sales price).

Flagstaff home prices continued to be higher than 2023 statewide averages, which also rose this year.

The Arizona Association of Realtors housing report for December 2023 shows the state's median home price had increased 8.7% from the previous year to $352,536.

Episode 4: Soft Landing, 4% Interest Rates, and a Special Guest

Chris Hallows and Renée Gaun talk through current buyer strategies including temporary buy downs and their pros and cons. We also hear from the Rundown guest Eric Fernandez, a financial advisor, on his market outlook. #flagstaff #Housingmarket #RealEstate #HallowsTeam #Local #Lender #Benchmark #Mortgage #NorthernArizona

Episode 5: Real Estate Lawsuit, Multigenerational Housing, and Inventory Lockdown

Chis Hallows and Renée Gaun discuss events of November 2023 such as the recent Burnett vs. NAR anti-trust lawsuit, benefits of multigenerational housing, and different views on the lock-in effect. #flagstaff #Housingmarket #RealEstate #HallowsTeam #Local #Lender #Benchmark #Mortgage #NorthernArizona #firsttimehomebuyer #realestateagent #mortgagecompany

In this episode of The Hallows Podcast, Wayne, Terri, and Chris talk about limited choices in a small town, tempo in the market, interest rates, and many other topics!